Ah, taxes. Quite possibly the least fun part about selling digital products, right?

The laws (and interpretations) are always changing, and the way governments see digital goods has evolved significantly since the digital product boom began. For a long time, many jurisdictions didn’t formally recognize digital products as taxable goods, and their taxation has continued to be an ongoing focus of debate and legislation.

As a digital store owner, you might be confused about how to proceed – and rightly so!

The truth is, digital product taxes have become largely unavoidable, but the good news is that we’ve collected some important bits of wisdom throughout our collective experiences here at EDD, and want to share them with you!

In this edition of The EDDit, we lay out some important tips for dealing with digital product taxes, so you can get your ducks in a row – and rest easy.

1. Make sure you actually need to pay sales tax

Although the taxation of digital goods has become a lot more widespread, it’s possible that it may not apply to you if you don’t meet the specific threshold for your local jurisdiction – or if your state or province doesn’t require tax on digital goods.

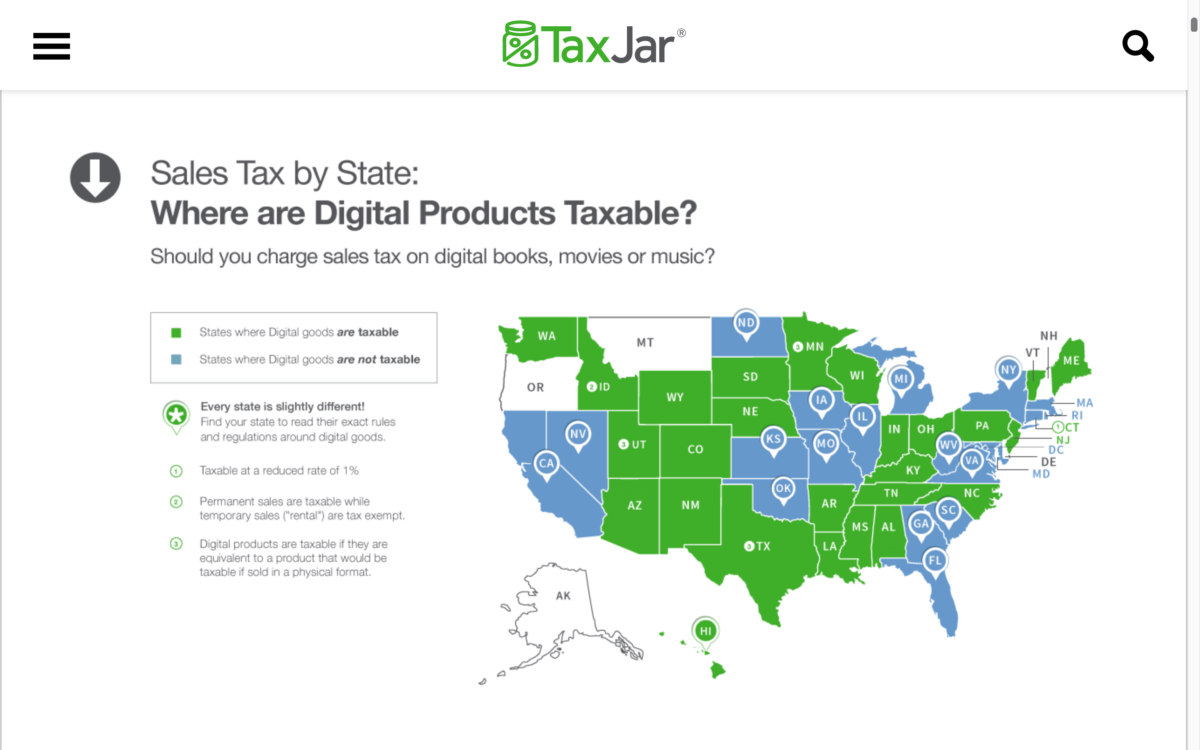

For example, many US states do not tax digital goods at all, while others tax them anywhere from 1-7%. Definitions of “digital goods” may vary as well, and some states have very specific requirements when it comes to taxing them; for instance, Colorado requires software to be physically packaged in order to be taxed.

Additionally, sales tax only applies to US companies with “sales tax nexus” – or a physical presence in the state, such as an office, for example.

To find out more about the digital tax requirements of US states, you can consult the Federation of Tax Administrators (FTA) remote seller state information (or the Streamlined Sales Tax Governing Board’s remote seller guidelines), peruse Wikipedia’s article on the taxation of digital goods, and check out the detailed guides by TaxJar and Quaderno.

If you’re in the EU, you probably need to pay value added tax (VAT); most countries have no tax threshold, and in 2017, a new EU-wide law came into place requiring digital products to be taxed at the sales tax rate of the member state – more specifically, the country where the purchase is made by the customer, regardless of where the store (or seller) is located.

You can refer to the European Commission’s guides on electronically supplied services and VAT rates for more information on digital goods and VAT in the EU.

If you’re in the UK you may need to register for VAT in the EU, but you might not have to register for domestic sales tax if you don’t meet the VAT threshold (depending on the size of your business).

You can find out more on the Gov.uk site.

If you’re an American company and you sell to customers in the EU, technically you could be held liable for VAT in the EU. If you’re a smaller operation, you might be able to fly under the radar for a while, but once you start to scale, you’ll be held accountable (alongside companies like Google Play and Amazon – both of which pay sales tax in the EU).

With any of these scenarios, you’d be wise to reach out to an accountant to find out what applies to your business, so that you’re not unpleasantly surprised come tax time! This brings us to tip number two…

2. Hiring an accountant is a wise investment

If you take your business seriously, you probably understand the need for outside help at times. This is particularly relevant when it comes to taxes!

Hiring an accountant is critical if you want to ensure that you stay compliant with all laws and requirements surrounding the taxation of digital products in your jurisdiction. It’s simply a component of your business that you can’t afford to mess up.

Of course, this is not to say that you couldn’t potentially handle it all on your own if you have the relevant expertise – but due to the complexities of dealing with international sales tax on a global scale, it’s not recommended.

3. If you run a marketplace, plan on collecting and paying sales tax

Regardless of the legal positioning between the buyer and the seller, governments worldwide are now holding marketplaces responsible for collecting and remitting sales tax. This is because the most up-to-date rules require sales tax to be based on the place of consumption, not the place of supply (as it had been previously), and the vast majority of marketplaces sell to international customers.

If you run a marketplace within the EU, you are responsible for registering with your local VAT MOSS provider and dealing with sales tax accordingly. The US has begun to adopt similar practices as well.

4. If you sell physical and digital products, different tax rates may apply

Typically, physical products are charged at the sales tax rate of the country where your business is registered – but with digital products, this may not be the case. Depending on where you live (and where your products are being purchased from), you may have to account for entirely different rates when dealing with sales taxes.

5. Most eCommerce platforms allow you to use third-party tax solutions

Some digital product sellers may not realize that the eCommerce platforms they’re using actually allow the integration of third-party tax solutions like TaxJar and others. Tools like these can make a huge difference when it comes to sales tax compliance, and staying on top of things like tax rate changes – not to mention your peace of mind!

Wrapping it up

Laws on digital product taxes will likely keep changing as eCommerce continues to grow and evolve, but hopefully we’ve given you some insights on some of these commonly-questioned topics. The benefits of selling digital products remain, even if the tax part can be confusing!

What wisdom do you have to share when it comes to dealing with digital product taxes? We’ve love to hear your input, so leave us a comment below!

Illustration by Jessica Johnston.