Important: This feature requires an active Easy Digital Downloads (Pro) license key and for the Easy Digital Downloads (Pro) plugin to be installed and activated. Don’t have Easy Digital Downloads (Pro)? Get it today!

Easy Digital Downloads supports EU VAT Tax and VAT Number validation without the need for any additional plugins of extensions. Before you get started, ensure you have updated Easy Digital Downloads to the latest version. This guide will walk you through enabling EU VAT collection with Easy Digital Downloads, as well as configuring automatic VAT Tax rate updates, and VAT Number validation.

Enabling EU VAT

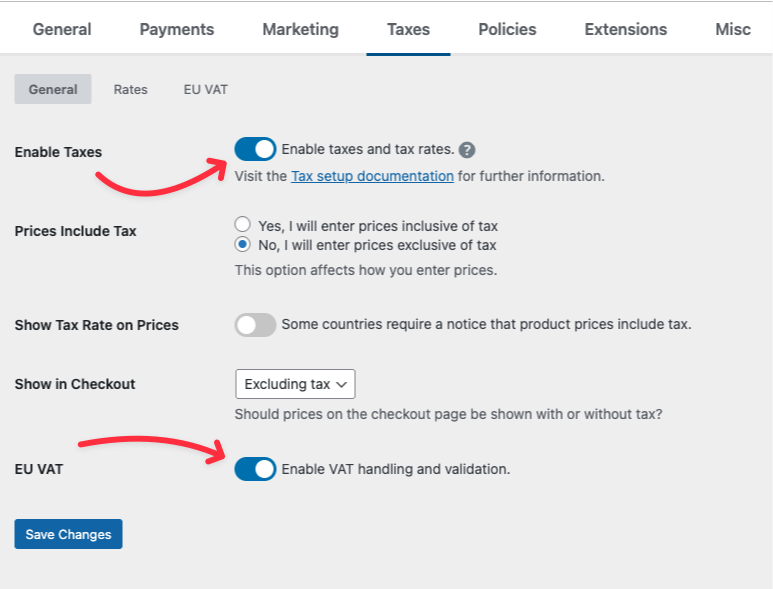

In order to enable EU VAT, you must first have the main Taxes enabled in EDD. Please navigate to the Downloads > Settings > Taxes page, then enable the Enable Taxes feature.

Once enabled, additional settings will show on this page, along with the EU VAT option at the bottom of the page. Enable the EU VAT setting and then click the Save Changes button.

Configuring EU VAT

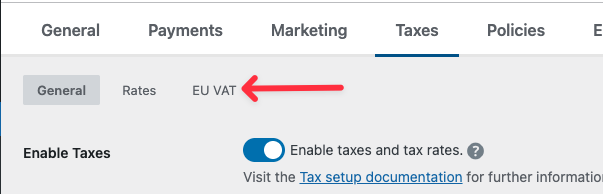

Once EU VAT is enabled, a new sub-menu item called EU VAT will be visible, where you can finish configuring your store for EU VAT.

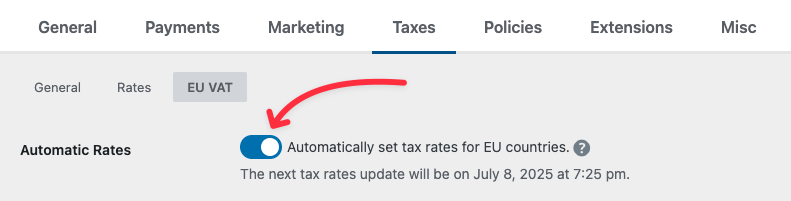

Automatic Rates

Next, you’ll want to keep your tax rates up to date is important, so Easy Digital Downloads can regularly check for new published VAT Tax rates and register them with your store. The automatic VAT Tax rates are available to both Free and Pro users of Easy Digital Downloads.

When this feature is enabled, your store will check our custom API for the latest VAT Tax rates for countries. This feature is not enabled by default and is opt-in.

Once activated and you’ve saved your settings, Easy Digital Downloads will schedule a background task to retrieve the latest rates. Please allow a few minutes for those rates to be retrieved. You will see an admin notice that this process is scheduled.

Important Note: Should you disable this feature, you will be required to monitor and update your EU VAT Tax rates manually.

Order Details

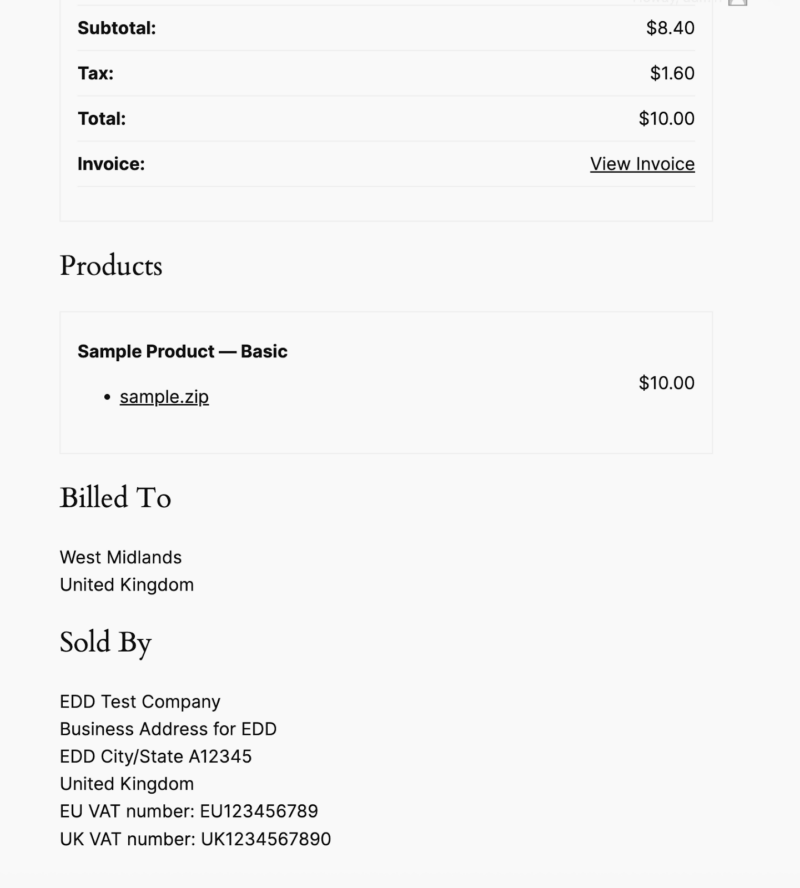

Enabling this option will show the VAT information on the customer receipt page.

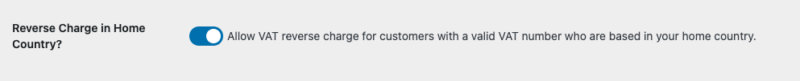

Reverse Charge in Home Country

By default, if your store is based in an EU member country, VAT will always be charged on sales to customers in your own country, even if they provide a valid EU VAT number.

This is because EU reverse charge rules do not apply to domestic transactions. In most EU countries, businesses are required to charge VAT on local sales, regardless of whether the customer is a consumer or a business.

If you’re located in an EU country that explicitly exempts domestic B2B sales from VAT when a valid VAT number is provided, you may enable this setting in Easy Digital Downloads. When enabled, VAT will be reverse-charged for domestic business customers, meaning they won’t be charged VAT at checkout—but they’ll be responsible for accounting for it themselves.

⚠️ Important: Only enable this option if your local tax authority allows domestic reverse charges for B2B transactions. Not all EU countries permit this. Please check with a tax professional to determine if you need this setting.

VAT Number Validation

Now that you are configured for collecting VAT Tax, you can ensure that your customers are supplying valid VAT Numbers at checkout with our validation feature. When required, a field will be shown at checkout for customers to enter their VAT Number and validate it before they complete their purchase.

Once you’ve activated your Easy Digital Downloads (Pro) license key, VAT Number validation at checkout is automatically handled for you!

Company Information

All the fields in this section will be displayed on the order details page(receipt) if you have enabled the ‘Order details’ setting above.

Country and Country of VAT Registration fields

Country – This defaults to the ‘Base Country’ selected in the general Easy Digital Downloads settings. You should change this if your store is NOT based in your base country.

Country of VAT registration – Use this field to select the country that issued your EU VAT number:

- If you are registered for VAT in the country where you are actually based, select your actual country.

- If you are registered for VAT in a different country (e.g., under the MOSS system) – Select ‘EU MOSS Number’.

If you are already using a 3rd Party Extension to add EU VAT Support

you learn about migrating to our built-in EU VAT feature.