Important: The EU VAT exports feature requires an active Easy Digital Downloads (Pro) license key and for the EDD Pro plugin to be installed and activated. Don’t have Easy Digital Downloads (Pro)? Get it today!

Easy Digital Downloads (Pro) includes several reports and export tools to make it easier to download the data necessary to submit your MOSS EU VAT returns. Before getting started, be sure that your site has the updated version of EDD Pro. For help getting started, read our guide on how to set up EU VAT.

Note: The information in this article is not tax advice. It’s provided to help understand the tools available with Easy Digital Downloads to aid in your MOSS VAT return submissions. All information should be verified with a tax professional.

There are three methods to export your MOSS VAT data from Easy Digital Downloads:

- EU VAT Summary Export. This is the easiest option. It’s best when your store’s main currency is the same currency that you have set in the MOSS VAT return.

- Third-Party Accounting Systems. Best if you’re using a system like Xero or QuickBooks and have added the VAT collected from each country.

- EDD Orders Export. Best if your store’s main currency differs from the currency used in the MOSS VAT return and you aren’t using a 3rd party system.

EU VAT Export: Summary Report

Easy Digital Downloads (Pro) provides a report that will summarize all VAT collected. The export will be provided in the same format that you will need when uploading/inserting into your MOSS tax return. This makes it quick and easy for you to file your returns.

What does this report contain?

The EU VAT Summary report contains all the necessary information needed for your MOSS return, by country. This includes:

- Country

- Standard VAT Rate

- Value of Items (Excluding VAT)

- VAT

This CSV is formatted to match the same way that your MOSS VAT return asks for it.

Exporting the EU VAT Summary

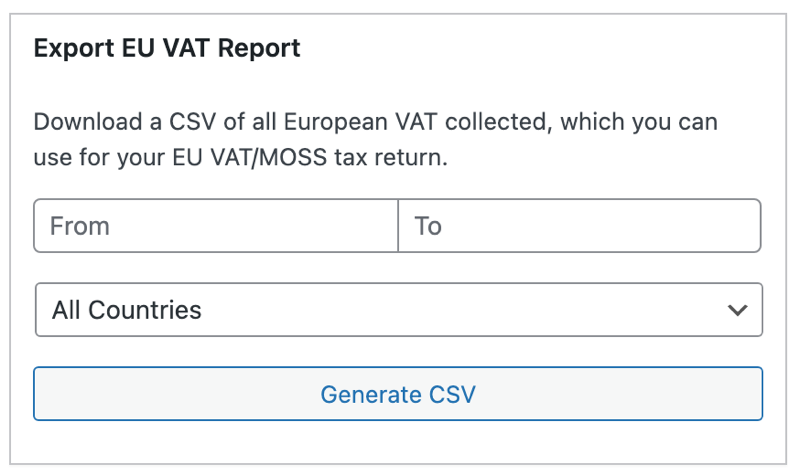

- Go to Downloads » Reports » Exports.

- Scroll down to the Export EU VAT export.

- Select the Start and End Dates for the period you are reporting for.

- Click Generate CSV.

- When the Export is done, a CSV file will be downloaded to your computer automatically.

- Open the CSV file using any spreadsheet software (Google Sheets and Microsoft Excel work great).

- This spreadsheet will contain all the information you need to input into your MOSS VAT return, separated by country.

Important currency information

The EU VAT Summary Export is provided based on the Easy Digital Downloads store currency found at Downloads » Settings » General » Currency. If you use our Multi Currency plugin, no additional steps are needed, as all price information for each payment is saved in your store’s main currency.

If your store currency does not match the currency that you need to submit your MOSS VAT return in, then you should use a different method.

Tax collected in your own country

If you are located in the EU, then you may notice that the report does not include details of the tax collected for your own home country. This is intentional, as the report generated is information you need for your EU VAT tax return, which should not contain tax collected in your home country. Tax collected in your home country should be submitted in your local tax returns.

Third-Party Accounting Systems

Many people use Easy Digital Downloads alongside an electronic accounting platform such as Xero, QuickBooks or Sage. If you add all your sales (including the tax collected and details of the customer’s country) to a separate system – either via manual import or by integrating your accounting system with EDD – then you can use this system to generate a report listing all the EU VAT that you collected during a specific period. You can use this report to create your quarterly MOSS return.

For instructions on how to generate MOSS VAT reports using this method, please consult the documentation for your chosen accounting system.

EDD Orders Export

You can use the Easy Digital Downloads Orders export to get the information you need for the MOSS VAT return.

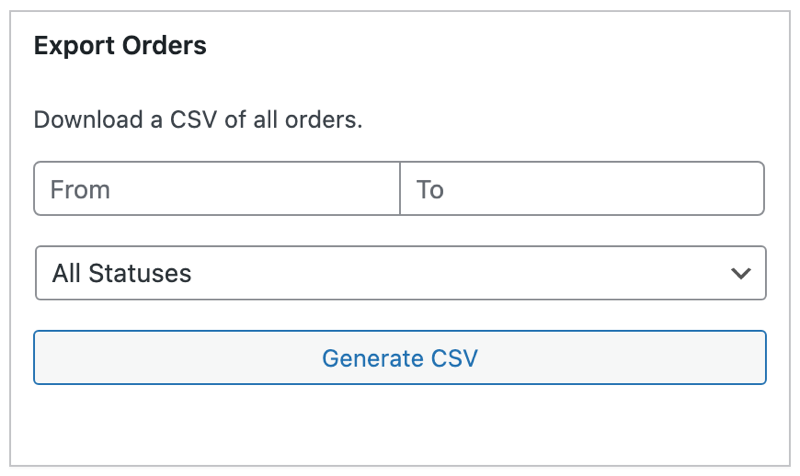

1. Go to Downloads » Reports » Export.

2. In the Export Orders tool, select the dates for the period for which you need to submit a tax return. Click the button to download the order records for ‘All statuses’.

3. This will save a CSV file to your computer. Open it using any spreadsheet software (e.g., Excel, Numbers, or Google Sheets).

4. Reformat the spreadsheet as follows (for instructions on how to sort columns, etc., please see the documentation for your spreadsheet software):

- Delete all the columns apart from ‘Country Name’, ‘Amount’, ‘Tax’ and ‘Date’.

- Sort the spreadsheet by the ‘Tax‘ column and remove all records where no VAT was paid, as you don’t need to report on these.

- Sort the spreadsheet by the ‘Status’ column and delete any statuses that you don’t need to report on. For example, you should remove ‘refunded’, ‘abandoned’ (if you are using an abandoned cart plugin), ‘failed’, ‘cancelled’ etc. If you are using the Recurring Payments extension, then you should keep all payments with the ‘complete’ and ‘edd\_subscription’ statuses because new sales and renewal payments should be included in your EU VAT tax return.

- Nex,t sort the spreadsheet by the ‘Country Name’ column.

- If your company is based in the EU or UK – Delete any payments from customers in your own country, because you will be submitting a separate domestic tax return for this and don’t need to include it in your MOSS return. (For example, if you’re in the United Kingdom then you should remove any UK sales and submit this on your UK tax return instead.)

- Insert a new row between the payments for each country.

- Now use your mouse to highlight the ‘Tax’ column for all the payments relating to the first country in the table (e.g. Belgium).

- If your store’s main currency is not Euros, then you should then look up the exchange rate published by the European Central Bank on the last reporting day of the VAT MOSS quarter (or if it’s a weekend, or bank holiday the next available day), and convert the totals for each country into Euros. This is essential because you must submit your MOSS return in Euros and not your base currency.

Use the SUM function to calculate the total price and VAT collected for that country. This is the information that you need to enter on the MOSS VAT return.

FAQs on EU VAT Report Exports

When do I have to submit my MOSS VAT returns by?

When collecting VAT from customers in the EU, it’s generally suggested that you submit your VAT return by the 20th of the month following the end of each quarter. This means by April 20th, you would submit data for the period of January 1 through March 31.

It’s also recommended to use the Mini-One-Stop-Shop (MOSS) system to handle submitting a single tax return and payment for the entire EU; it allows you to register for a European VAT number, regardless of your location.

What if a country’s VAT rate changed during the period covered by my return?

EU countries normally change their VAT rates at the end of a reporting period, so this is unlikely to happen. If it ever does happen, then the report will show the latest VAT rate if it has changed. The amounts collected will be correct, so long as you keep Easy Digital Downloads itself up to date.

If you have “Automatic VAT Rates” enabled, EDD will take care of updating tax rates automatically.

How do I download an EC Sales List?

In addition to the MOSS tax return, if you are in an EU country, then you may need to submit a list of all your sales where the VAT was reverse charged.

Easy Digital Downloads also includes an export for this purpose.

To create the report, go to Downloads » Reports » Export, and find the Export EC Sales List report. You can then select the start and end date that you are reporting on, and download the data into a CSV file.

The report contains all the information that is required for the EC Sales List. You can open it using any spreadsheet software.