This guide will walk you through transitioning from the third-party Easy Digital Downloads – EU VAT plugin to the native VAT functionality now built into Easy Digital Downloads (EDD).

The migration process is designed to be straightforward and seamless. Most importantly, all of your existing order data, including VAT information, will remain intact and unchanged. While we have improved the data handling and validation, it is stored and displayed in a way to ensure you will not lose any historical records.

The first step to enabling the built-in EU VAT feature for Easy Digital Downloads, is to ensure you have updated to the latest Easy Digital Downloads plugin version.

Important: This feature requires an active Easy Digital Downloads (Pro) license key and for the Easy Digital Downloads (Pro) plugin to be installed and activated. Don’t have Easy Digital Downloads (Pro)? Get it today!

Switching to built-in EU VAT

Once you have updated, all you have to do is enable the setting, and Easy Digital Downloads handle the rest.

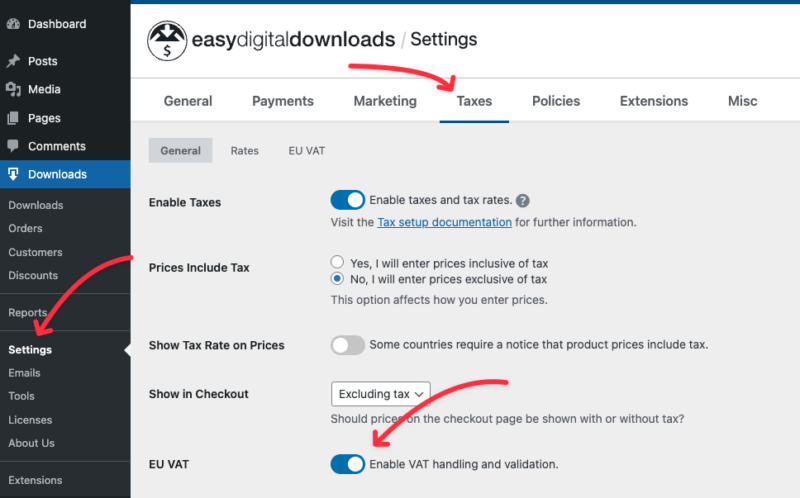

Navigate to Downloads > Settings > Taxes in your WordPress Dashboard

Now ensure you have the Enable Taxes setting toggled on, and you can then enable the EU VAT option at the bottom of the settings.

Note: The EU VAT feature in Easy Digital Downloads (Pro) is not enabled by default, in order to prevent any conflicts or customizations you may have with the Easy Digital Downloads – EU VAT extension. Easy Digital Downloads will not automatically switch your site over to our native EU VAT support without your explicit action to enable it.

That is it! Once you enable the Easy Digital Downloads VAT setting, Easy Digital Downloads – EU VAT plugin will be automatically deactivated to prevent any conflicts.

Key Changes and Improvements in EU VAT

While the transition to our built-in EU VAT feature is simple, we have added some additional time-saving features and improvements to streamline your experience.

Improved VAT Rate Management

To ensure a smooth transition, EDD will automatically import the rates you were using in the third-party plugin and register them as official tax rates within EDD. This means that all aspects of Easy Digital Downloads are natively aware of your VAT tax rates, including settings, reporting, and exports.

Note for advanced users and developers: If you were using the edd_vat_current_eu_vat_rates filter to modify rates, the migration process will respect your filtered values.

New Automatic Rate Updates

You can now enable Automatic Rates from the EU VAT settings screen. This adds a weekly task to your site that checks our VAT Rate API for the latest official EU tax rates. If a country’s rate has changed, EDD will update it for you automatically, ensuring you have the latest published rates.

We know keeping your tax rates updated is important and you should not have to wait for an update to Easy Digital Downloads (Pro) to get them, so we’ve made this feature available to all Easy Digital Downloads users, Lite and Pro, via our own VAT Rates API.

Note: This automatic process will not overwrite any tax rates that you have manually created. The Automatic VAT Rates feature is opt-in.

Simplified UK VAT Validation

VAT Number validation is now included automatically through our API. Not only does this simplify your store’s configuration, but helps ensure we can continue to ensure continued compatibility without the need for a plugin update.

Looking for more information about our EU VAT feature?

You can read more in our How to Set Up EU VAT article.