If you sell digital goods to customers in the EU or UK, you know how sticky Value Added Tax (VAT) compliance can get. Improper EU VAT handling brings the risk of hefty fines and legal complications.

That’s why Easy Digital Downloads now includes built-in EU VAT handling and validation for Pro users! 🥳

This significant update simplifies VAT compliance for digital product sellers using EDD. It eliminates the complexities of country-specific rates, reverse charges, and VAT number validation.

Learn about the new capabilities included in the latest Easy Digital Downloads release.

The Importance of EU VAT for eCommerce

What Is EU VAT?

EU VAT (Value Added Tax) is a consumption tax applied to the sale of digital goods and services within the European Union (EU) and the United Kingdom (UK).

Suppose you use Easy Digital Downloads (EDD) to sell digital products (such as eBooks, software, or online courses) to customers in an EU or UK country. You are legally required to collect this tax, regardless of your business’s physical location.

Key Requirements for EU/UK Digital Sales:

- Charge Correct VAT Rate: Apply the specific VAT rate based on the buyer’s country of residence.

- Validate VAT Numbers: Validate the buyer’s EU VAT number to apply the reverse charge mechanism, where the buyer is responsible for accounting for the VAT.

- Maintain Records & Reports: Keep detailed records of all transactions and submit regular VAT reports to the relevant tax authorities.

Failure to comply with these regulations can result in significant fines, legal complications, and potential restrictions on selling within the EU/UK market. Therefore, robust EU VAT handling is critical for any WordPress-powered store operating globally.

What’s New: EDD EU VAT Handling 🔎

Easy Digital Downloads now integrates comprehensive EU VAT handling directly into its core. This eliminates the need for external extensions or additional fees often required by other eCommerce platforms.

The native system simplifies VAT management through your EDD settings, providing the following key functionalities.

- New EU VAT Settings Tab: Centralized configuration for all VAT-related settings.

- Automatic VAT Rates/Calculations: Real-time updates and accurate computation of VAT.

- VAT Number Validation at Checkout: Streamlined validation process for transactions.

- Simple Order, Invoice & Report Management: Integrated VAT data for effortless record-keeping and reporting.

New EU VAT Settings

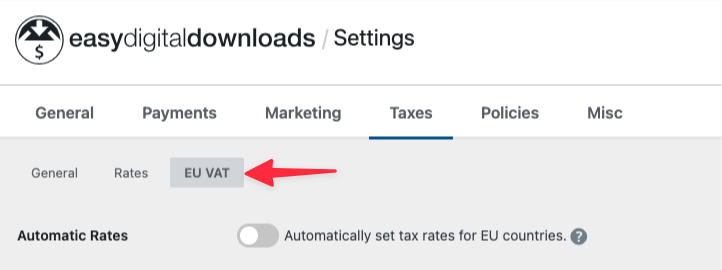

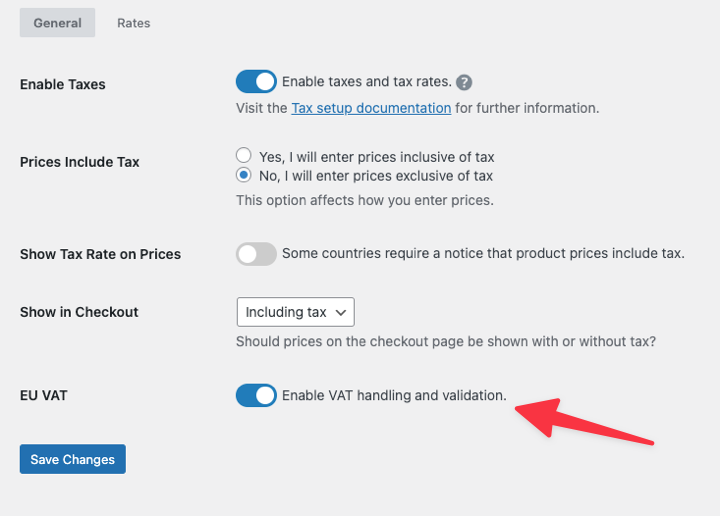

A new EU VAT settings tab has been added under Downloads » Settings » Payments » Taxes.

Note that you can only enable VAT handling and access the associated settings if taxes are also enabled.

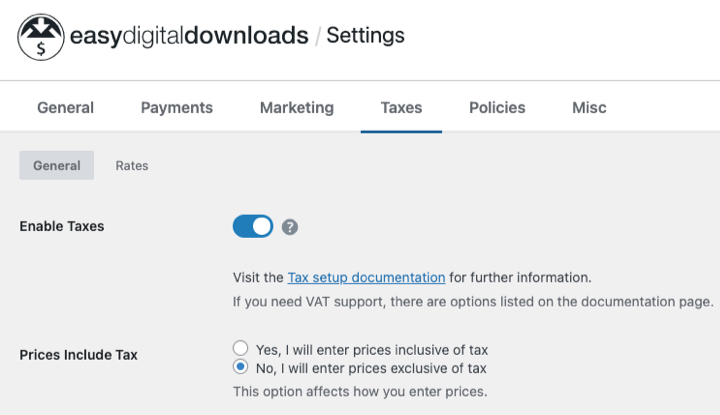

Automatic VAT Rates

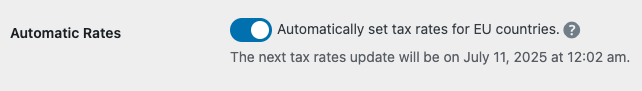

Once you enable VAT, EU tax rates are added to your site automatically.

We connect to our servers weekly to ensure you always have the latest EU tax rates without any manual work.

The system handles all complex VAT calculations behind the scenes. No more manual updates, and no risk of falling behind on compliance.

Learn more about EDD Tax settings.

VAT Number Validation at Checkout

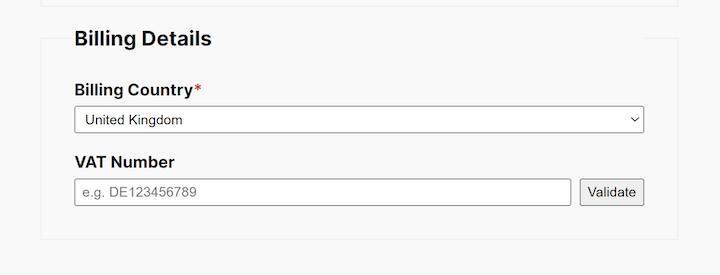

Easy Digital Downloads integrates real-time VAT number validation directly into the checkout process. This field is contextually displayed only for customers in EU/UK countries, maintaining a clean checkout experience for others.

Upon entering a VAT number, customers can validate it instantly without leaving the checkout page. When a valid VAT number is entered, EDD automatically performs the following:

- Instant Validation: EDD validates the VAT numbers against the appropriate authority.

- Dynamic Tax Application: Applies the correct tax rate or, crucially, applies a reverse charge (zero tax) if the valid VAT number indicates a transaction where the buyer is responsible for VAT.

- Ensures Compliance: The automated application of reverse charges significantly simplifies compliance for sales within the EU/UK.

Seamless Order, Invoice & Report Management

Easy Digital Downloads enhances record-keeping and reporting for VAT compliance. VAT-related information is automatically captured and integrated across your store.

A dedicated VAT section is added to all orders, accessible under the Order Details » VAT tab on an individual order page.

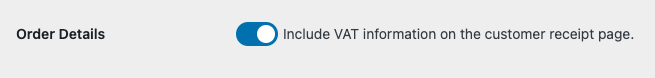

This information can also be displayed on customer receipts by enabling the Order Details option in EDD VAT settings.

Invoices: VAT details, including your company’s VAT information and relevant order data, are automatically integrated into EDD invoices.

Comprehensive Reports: New VAT reporting features are available for streamlined accounting. You can access and export detailed reports on:

- Orders with VAT collected.

- Orders with reverse charges applied.

Find and export these reports under Downloads » Reports » Export. Then locate the EU VAT and EC Sales List sections.

How to Enable EU VAT Handling for EDD

Enabling EU VAT handling in Easy Digital Downloads is a straightforward process, taking less than 5 minutes. Follow these steps to get started.

Prerequisite: Ensure that you have a valid and active Easy Digital Downloads (Pro) license key and that you’re using an updated version of the EDD Pro plugin. You can check under Dashboard » Updates in your WordPress admin area.

Step 1. Enable Taxes & EU VAT Handling

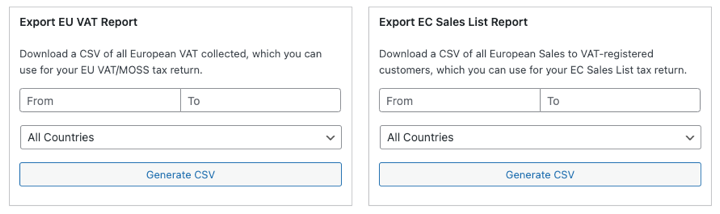

Before you’re able to enable and configure EU VAT settings, you need to have taxes enabled.

To do that, go to Downloads » Settings » Taxes from your WordPress dashboard.

Select the option to Enable Taxes.

Then toggle to Enable VAT handling and validation.

Remember to select Save Changes.

A new EU VAT setting will appear under the Taxes » General tab.

Step 2. Configure Your EDD EU VAT Settings

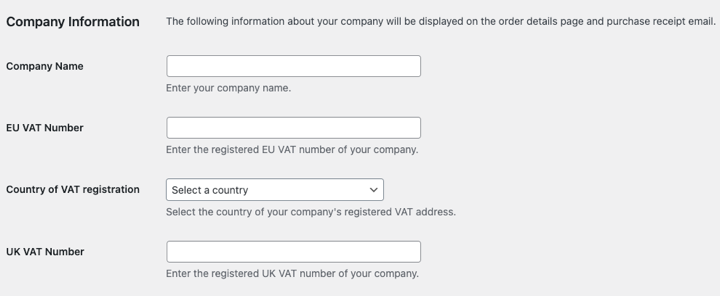

After you turn on the EU VAT setting and save your changes, go to the EU VAT tab that’s now under Taxes.

This is where you can configure the EU VAT handling and validation settings.

The first option is Automatic Rates. If you choose to enable rates updated weekly, you’ll see a note that it’s scheduled to happen.

Alternatively, you can use the ‘legacy’ tax rates.

Next, add your business information. Enter your company’s VAT number and select your country of VAT registration.

For EDD Pro users with active licenses, VAT validation runs through our premium servers automatically — no need for external API keys or additional service fees.

Click on Save Changes when you’re done.

Step 3. Test Your EU VAT Validation

Your store is now ready for VAT handling and validation. But it’s important to verify that everything is working as it should.

With VAT handling enabled and taxes registered for EU countries, visit your store’s checkout page.

Select various EU/UK countries as the billing country to ensure the VAT number field appears automatically. It should not appear for non-EU/UK countries.

Enter a test VAT number.

Once you enter the VAT number, click the Validate button.

If numbers are invalid, the field lets customers know right away—no guesswork.

Observe Reverse Charge Logic

- If a VAT number is valid and the checkout country does not match your store’s base country, a reverse charge should be applied, and no tax collected on the order.

- If the checkout country matches your store’s base country, tax collection depends on the Reverse Charge in Home Country? setting. For example, if your company is in France and a French customer enters their VAT number, tax would be collected unless this specific setting is enabled.

⚙️ For more in-depth guidance, please refer to our official EU VAT documentation.

Other EDD Updates

There are a handful of other improvements in this update, including:

- Our popular Invoices extension is now built into the Easy Digital Downloads (Pro) plugin.

- All users (Lite and Pro) can customize the empty cart message.

- Pro users can also redirect to a page or custom URL if a user visits the checkout with an empty cart.

FAQs on EU VAT for Easy Digital Downloads

Here are answers to common questions about EU VAT handling in Easy Digital Downloads.

What is EU VAT and how does EDD handle it?

EU VAT (Value Added Tax) is a consumption tax required for digital product sales to customers in the EU and UK. Easy Digital Downloads introduces built-in functionality for Pro users to automate EU VAT rate calculations, VAT number validation, and reverse charge application, ensuring compliance directly within the plugin.

EDD Pro users benefit from native validation via EDD’s servers, eliminating the need for external accounts or additional fees. This is ideal for growing digital shops with significant EU/UK sales.

How do I enable VAT for Easy Digital Downloads?

To enable VAT in Easy Digital Downloads, first activate taxes under Downloads » Settings » Taxes, then toggle the “Enable VAT handling and validation” option.

Is EU VAT Handling automatically kept up to date in EDD?

Yes, if the “Automatic Rates” option is enabled in your EDD EU VAT settings, Easy Digital Downloads automatically updates EU VAT rates weekly to ensure your store remains compliant with the latest regulations.

Make EU VAT Compliance Effortless

Don’t let VAT complications hold back your digital business growth any longer.

Update Easy Digital Downloads Pro to the latest version today and start confidently selling to EU customers. Your future self will thank you for making VAT compliance this simple.

If you haven’t already, upgrade from a Lite to a Pro pass for automatic VAT handling and even more cost-saving features!

For more info and help:

📣 P.S. Be sure to subscribe to our newsletter and follow us on Facebook, Twitter/X, or LinkedIn for more WordPress resources!

Using WordPress and want to get Easy Digital Downloads for free?

Enter the URL to your WordPress website to install.

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.

2 comments

Comments are closed.

Given EDD Pro now has VAT stuff built in, I’m inclined to try and get it done:

1. Do you have any recommendations for quickly getting prerequisite VAT # registration reliably for our industry ( online software licensing business like yours )?

2. What are the most cost effective and simple to use solutions that would work from EDD VAT report exports?

I assume you built this with your own needs in mind, so likely the output of the report exports is nearly perfect for at least one service provider to ingest and handle submissions to countries etc.

What is everyone else doing here now?

Hi Daniel! If you reach out to our support team they can answer these questions for you 🙂