If you want to prevent chargebacks and dispute fees from hurting your online business, Stripe early fraud warnings can help.

Online fraud is a silent thief. Chargebacks, disputes, and fraudulent transactions can cut into your profits and damage your reputation.

Research shows that—after processing and chargeback fees— merchants can wind up paying nearly 3x the cost of a disputed transaction!

The good news is that there are simple ways for you to minimize and avoid such issues, which I’ll walk you through.

🔎 In this article, I’ll cover:

What Are Early Fraud Warnings?

Early fraud warnings (EFWs) are proactive alerts issued by payment processors (like Stripe) when a transaction is flagged as potentially fraudulent.

The process generally looks like this:

- A cardholder disputes a charge with their issuing bank.

- The bank notifies the payment processor (Stripe).

- Stripe alerts the merchant (you).

These early fraud warnings happen before formal chargebacks are initiated. This gives you a crucial window of opportunity to look into the order and take action (i.e., process a refund) before the cardholder files a dispute.

Not all early fraud warnings from Stripe escalate to chargebacks. But they do signal a potential problem that requires attention.

Importance of Stripe Early Fraud Warnings

The impact of fraud on online businesses is staggering. Research estimates that chargeback fraud will cost merchants over $28 billion by 2026.

This highlights the importance of implementing robust fraud prevention measures. Acting early and quickly on early fraud alerts often lets you resolve the issue with the customer directly.

Stripe early fraud warnings can help:

- Prevent chargebacks & dispute fees. Addressing issues before they escalate into formal disputes can save you from costly fees and penalties.

- Maintain customer trust. Frequent chargebacks can damage your business’s reputation. Effectively managing early fraud warnings prevents unnecessary investigations. In turn, this reduces disruptions to legitimate customers. Plus, it shows a commitment to customer satisfaction and security, which builds trust.

- Protect your bottom line. Chargebacks and fraud can significantly impact your bottom line. Early fraud warnings allow you to prevent financial losses by identifying and resolving fraudulent transactions before they damage your revenue.

Stripe’s Early Fraud Warning System

Stripe is a popular and preferred global payment processor for many reasons. I appreciate how powerful yet versatile and user-friendly it is. I recommend the Stripe payment gateway to online sellers, including our Easy Digital Downloads users.

It’s also an excellent option if you’re new to the world of eCommerce.

Stripe automates, simplifies, and secures the eCommerce checkout process. In addition to letting you easily accept debit/credit cards and digital wallet payments, you can save customer payment details via Stripe Link for quick and safe transactions.

I could go on about its benefits. But for this post, let’s focus on how it can help safeguard against unnecessary disputes and chargebacks.

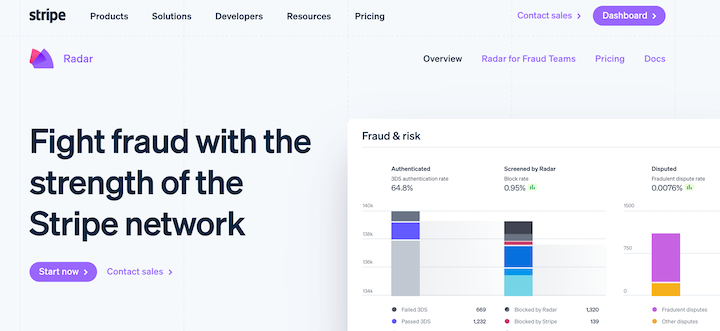

The Stripe Radar fraud prevention system helps protect your business from fraudulent transactions. It uses real-time monitoring and machine-learning algorithms to identify suspicious activity.

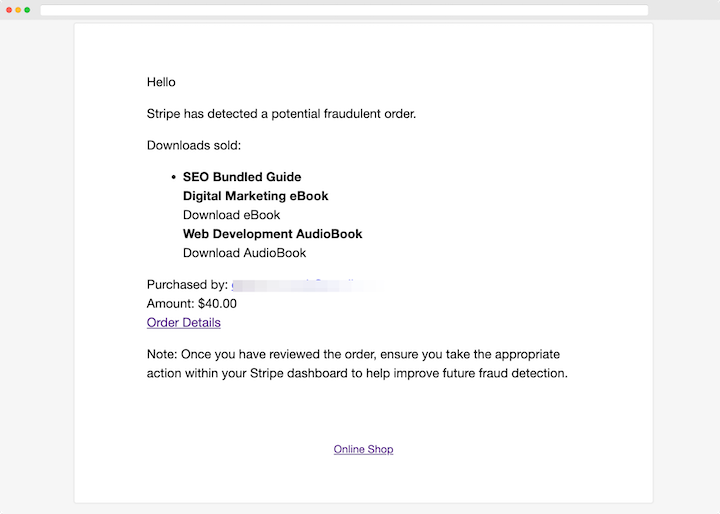

Stripe provides key information about the flagged transaction, like the reason for the warning. Plus, it integrates seamlessly with Easy Digital Downloads. So when an early fraud warning triggers in Stripe, you’re automatically notified via email.

How to Use Stripe Early Fraud Warnings

Stripe is compatible with most eCommerce platforms and plugins. But the configuration process can vary. This post focuses on Easy Digital Downloads (EDD) users.

Don’t have a digital store yet?

Use Easy Digital Downloads (EDD). EDD turns your WordPress site into a full featured store purpose-built for selling digital products like PDFs, graphics, eBooks, online courses, apps, or software.

Run your entire business from your WordPress dashboard! Learn more about creating an online store with WordPress.

Step 1. Install Easy Digital Downloads

If you’re an existing Easy Digital Downloads and Stripe user, go ahead and skip this step.

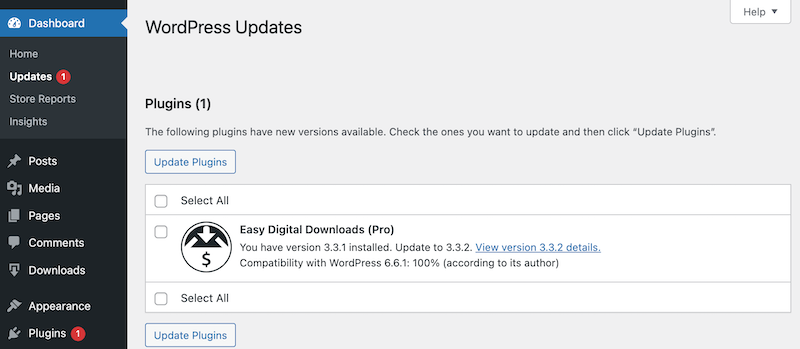

However, I encourage you to check that you’re using the most updated version of the EDD plugin. (EDD v3.3.0 and higher lets you configure those automatic fraud warning emails I mentioned.)

If an update is available, you can find it under Dashboard » Updates from your WordPress admin area.

The free Lite EDD plugin supports Stripe. However, upgrading to EDD Pro unlocks access to way more EDD tools and Stripe features. For example, a paid EDD pass eliminates the Stripe transaction fees you’d otherwise be responsible for.

🔎 New to Easy Digital Downloads? Feel free to use the following video and our EDD Quickstart guide for step-by-step guidance on getting started.

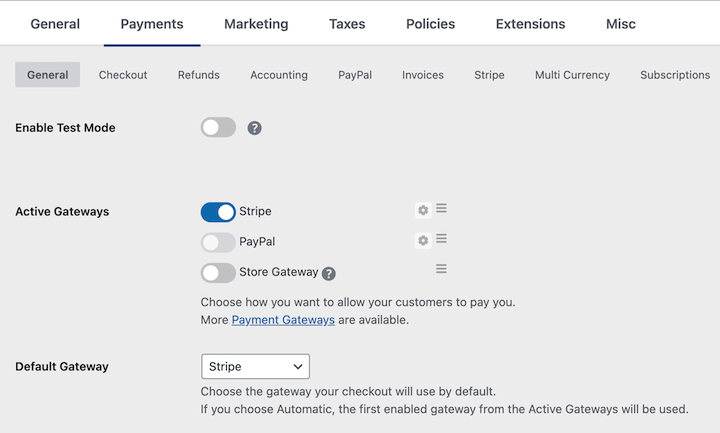

You can set Stripe as your default and active gateway under Downloads » Settings » Payments.

When you’re done, click Save Changes at the bottom of the screen.

Step 2. Connect Your Stripe Account

The next step is to create a Stripe account or connect your existing account to your EDD store.

To create a Stripe account, visit the Stripe website and follow the signup process. Once you have an account, connect it to your Easy Digital Downloads store.

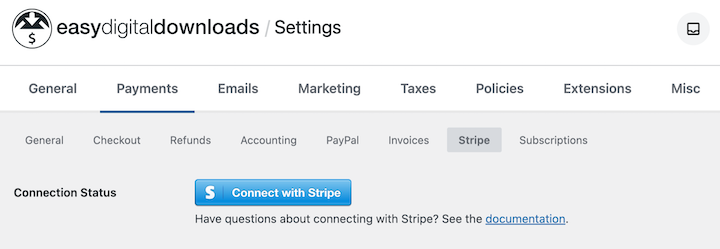

Under Downloads » Settings » Payments, click on the Stripe tab followed by Connect with Stripe.

Follow the prompts to complete the process and configure the webhooks.

⚙️ This process is important; a specific webhook is needed to enable Stripe early fraud warning emails. If you’re a beginner and this part seems overwhelming, don’t worry. Our Stripe documentation has step-by-step guidance.

Save your settings changes when you’re done.

Step 3. Configure Stripe Radar & Fraud Prevention Settings

While I won’t go into it in this post, Stripe also lets you customize the Radar fraud prevention preferences and settings.

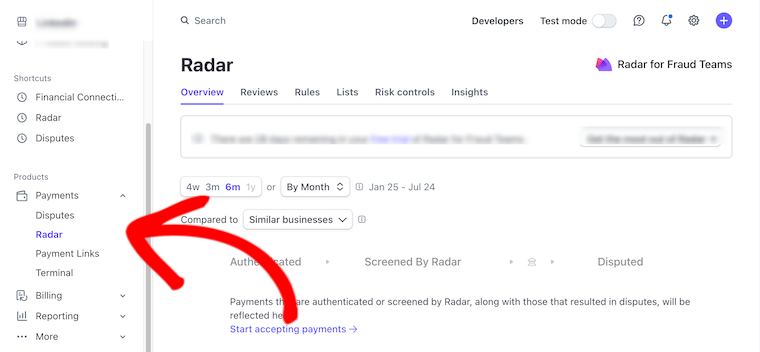

You can access the Radar tools from your Stripe dashboard (Payments » Radar).

From here, you can manage the rules and risk controls, allow/block lists, optimize reviews, etc. I recommend checking out the Stripe Docs to explore your options.

Step 4. Enable Emails for Stripe Early Fraud Warnings

As I mentioned, Easy Digital Downloads lets you enable email alerts that automatically notify you when Stripe early fraud warnings are detected.

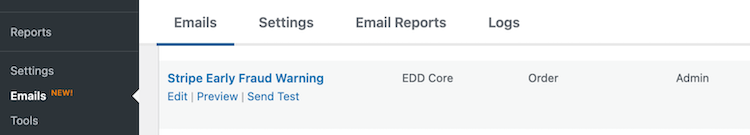

From your WordPress dashboard, under Downloads » Emails, you’ll find a list of customizable emails, including Stripe Early Fraud Warning.

Hover over the name to Edit, Preview, or Send Test email.

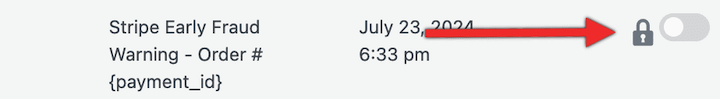

In the last column (next to the padlock icon) is the Status toggle switch for enabling/disabling early fraud warnings from Stripe.

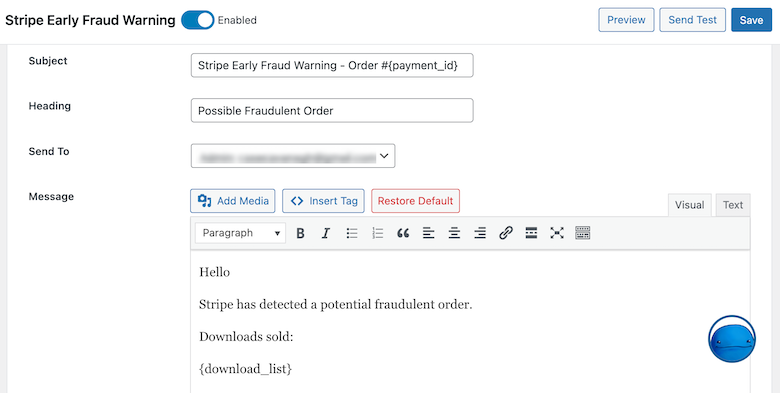

When you click Edit, there’s also the enable option at the top of the page.

Here, you can customize the email subject line and heading, ‘Send To‘ user, and body text and tags.

When you’re done, click Save in the top-right corner.

Preview it from your site’s front end to verify that it looks okay.

Finally, send a test email to ensure the subject line and other elements appear and function correctly.

Tips for Handling Stripe Early Fraud Warnings

When you receive an early fraud warning, it’s essential to follow best practices to protect your business. Below are some key tips to keep in mind.

- Review the order details: Carefully examine the order information, including shipping address, billing address, and customer behavior.

- Verify customer identity: Contact the customer to confirm the order and address any concerns.

- Check for red flags: Look for signs of fraudulent activity, such as unusual purchase patterns or suspicious order details.

- Document your investigation: Maintain detailed records of your interactions with the customer and any actions taken.

By following these steps, you can increase your chances of resolving the issue without incurring a chargeback.

FAQs About Early Fraud Warnings

Let’s wrap up with some frequently asked questions about early fraud warnings and fraud prevention.

What is an early fraud warning on Stripe?

An early fraud warning is a notification from Stripe indicating a potential fraudulent transaction. It gives you an opportunity to investigate and resolve the issue before a chargeback occurs.

How are early fraud warnings different from chargebacks?

An early fraud warning is a proactive alert, while a chargeback is a formal dispute initiated by the cardholder. EFWs give you a chance to prevent chargebacks.

How do early fraud warnings happen?

Early fraud warnings can occur due to various factors, including suspicious transaction patterns, mismatched information, or other red flags identified by Stripe’s fraud prevention system.

What should I do if I receive an early fraud warning?

When you receive an early fraud warning, carefully review the order details, verify customer identity, and take appropriate action based on your investigation.

How can I prevent Stripe early fraud warnings?

While you can’t completely prevent early fraud warnings, you can reduce their frequency by implementing strong fraud prevention measures, such as address verification, CVV checks, and customer identity verification.

Automate Stripe Early Fraud Warnings With EDD

Understanding and utilizing early fraud warnings in Stripe can significantly improve your online store’s security and protect your bottom line.

By following the steps outlined in this guide and implementing best practices, you can effectively manage potential fraud and build a stronger, more resilient business.

To automate fraud warning alerts and protect your online store with additional tools, consider grabbing an Easy Digital Downloads pass today:

Want to continue learning about eCommerce best practices? Check out our blog post on sending post-purchase emails!

📣 P.S. Be sure to subscribe to our newsletter and follow us on Facebook or Twitter for more WordPress resources!