Are you trying to figure out how to set up automated tax calculation in WordPress?

If you’re running an online store, you’re probably aware of the importance of tax compliance. Tax rules and regulations can vary from state to state and country to country. Keeping up with them can be challenging.

To help, many premium tax calculation tools like Stripe Tax and TaxJar are available that dynamically calculate and collect tax based on the customer’s location. But tools with this type of functionality often come at a cost. And not all small businesses and individual store owners can afford them.

Fortunately, if you sell digital goods, you don’t have to worry about that. Easy Digital Downloads (EDD) gives you an automated tax calculation tool for WordPress…. and it’s free!

🔎 In this article, we’ll cover:

Why Is Automated Tax Calculation Important?

As I mentioned, sales tax laws are complex and can vary widely. For example, in the US, some states require vendors to collect sales tax on digital products, while others don’t. Similarly, tax rates can vary from one county or city to another.

Manually calculating tax for each sale can be a daunting task, especially if you have customers from different regions. You may end up spending more time on tax compliance and tax reports than on your core business activities.

Plus, inaccurate calculations can lead to penalties, legal disputes, and damage to the reputation of your business. Therefore, it’s crucial to have a reliable tax calculation tool that ensures compliance with tax laws.

To simplify the process, tax calculation tools like Stripe Tax and TaxJar have been developed. These premium sales tax automation tools can be incredibly helpful. They help vendors stay tax compliant regardless of where they sell products. Unfortunately, they come at a cost.

That’s where Easy Digital Downloads comes in. In the next section, we’ll walk you through how to set up automated tax calculations in WordPress for free!

How to Add Automated Tax Calculation in WordPress

Ready to get started? Below, I’ll walk you through how to set up automated tax calculations in WordPress for free using Easy Digital Downloads.

Step 1: Get Easy Digital Downloads

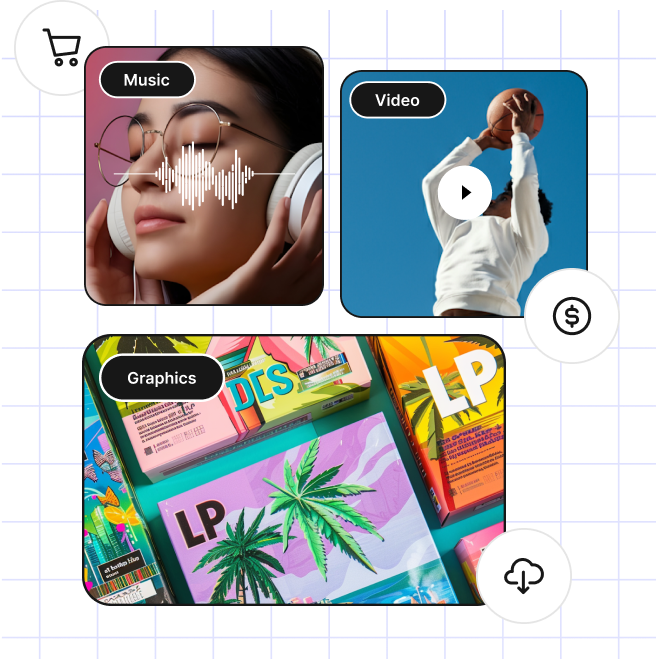

If you’re unfamiliar, Easy Digital Downloads is the best WordPress plugin for selling digital products and goods. This includes things like eBooks, software, templates, and much more.

EDD is powerful, user-friendly, and gives you everything you need to start an online store quickly. It’s the ideal solution if you don’t offer physical items and, therefore, don’t need/want a WooCommerce store.

Easy Digital Downloads offers a FREE feature that dynamically calculates and collects tax based on your customer’s location. While there are four pricing plans that you can choose from, the automated tax calculation is a feature available to all EDD users, even the free version.

🏷 Learn more about EDD Free vs EDD Pro

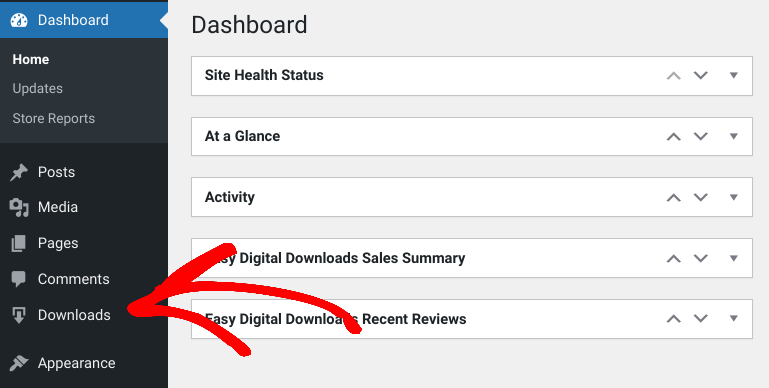

To install Easy Digital Downloads, you can go to Plugins » Add New. Search for Easy Digital Downloads, then click on Install Now. Select Activate Plugin.

This will add a Downloads menu item to your WordPress dashboard:

For help setting up your EDD store, you can use these guides:

eCommerce without limits!

That is our promise. Most eCommerce solutions limit your creativity

…not Easy Digital Downloads!

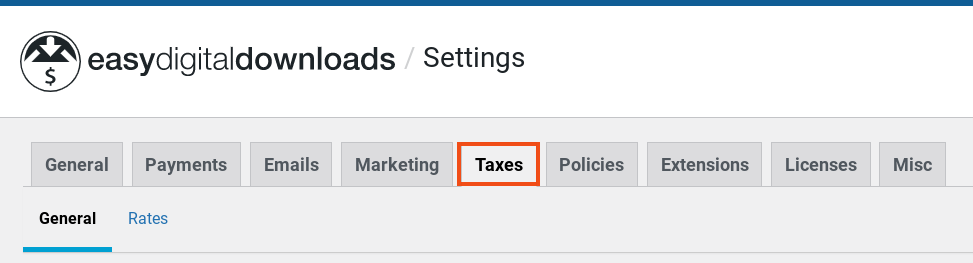

Step 2: Configure the Tax Settings

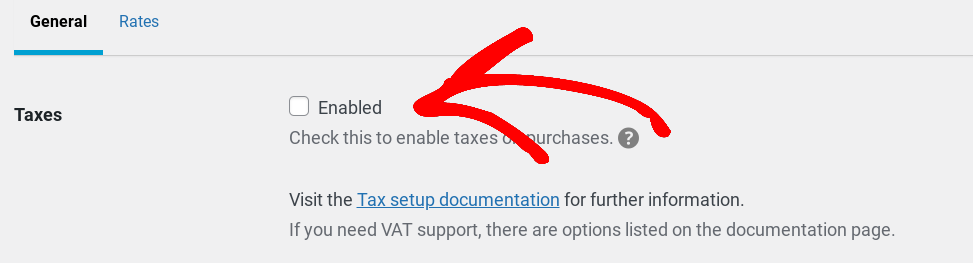

After you’ve completed the initial setup, you can configure the tax settings. To start, go to Downloads » Settings » Taxes:

Select the Enabled checkbox next to Taxes:

When applicable, EDD will require shoppers to enter their billing address/shipping address at checkout so the eCommerce sales tax calculations apply accordingly.

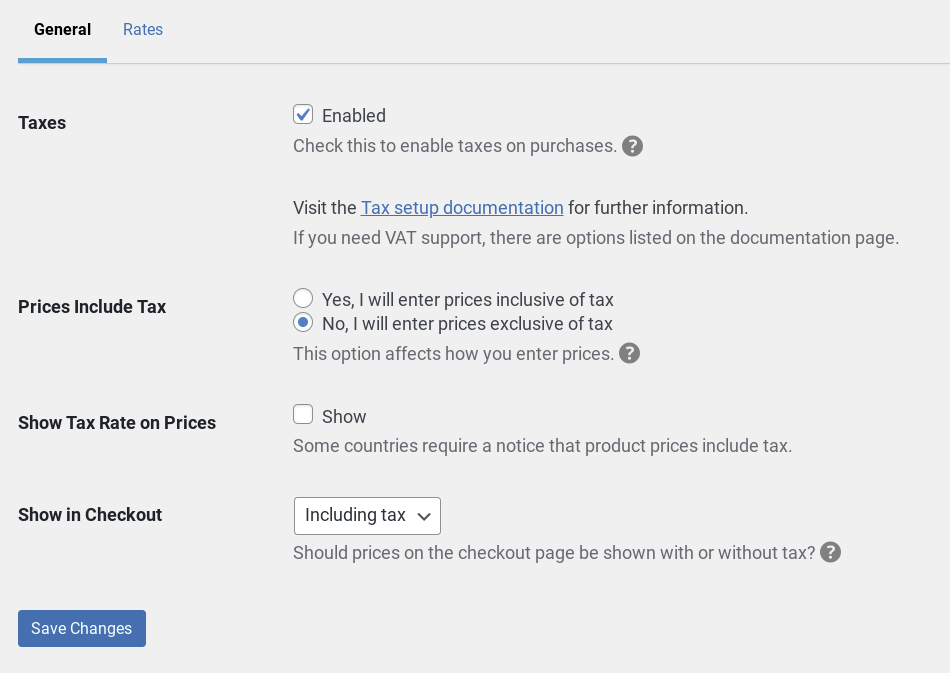

General Tax Settings

Next, you can configure the sales tax rules for purchases:

You can choose whether to include taxes in your total price displayed to customers on the product page. If you select No, the tax subtotal amounts won’t be calculated or added to the product prices until checkout.

The Show Tax Rate on Prices option, you can determine the amount the customer is expected to pay in taxes below the purchase buttons.

Next, under the Show in Checkout dropdown menu, you can choose to show prices on the checkout page with or without tax.

When you’re done configuring these settings, remember to click on Save Changes.

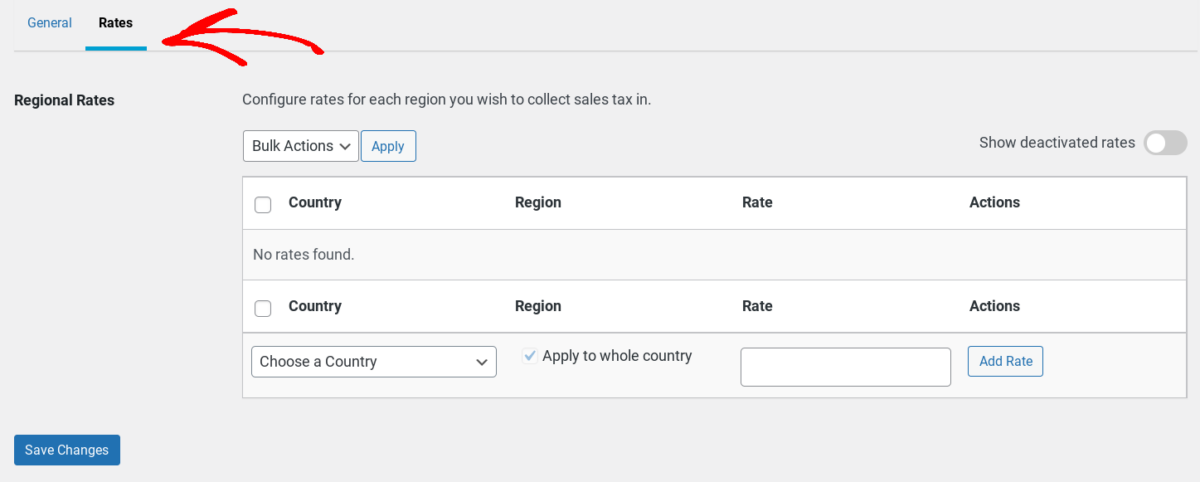

Step 3: Add Tax Rates for Each Region

Next, you can configure rates for each region you want to collect sales tax in. To do this, go to Rates under the tax tab:

Select the Choose a Country and pick an option:

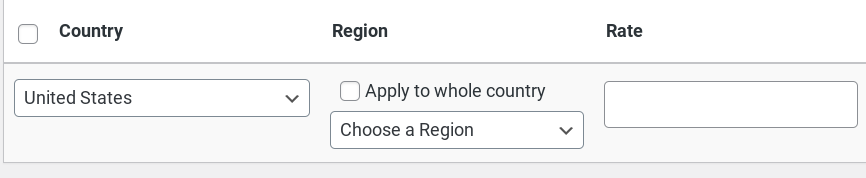

You can click Apply to whole country, which is the default. De-select this option to apply tax only to certain locations. Then select Choose a Region.

Enter the tax Rate text field, then select Add Rate.

⚙️ For more on EDD tax settings, refer to our documentation.

Step 4: Upgrade to EDD Pro for IP Geolocation Support

As I mentioned earlier, you can use EDD for free automated tax calculations in WordPress. However, if you want to take it a step further, you can upgrade to EDD Pro for IP geolocation support.

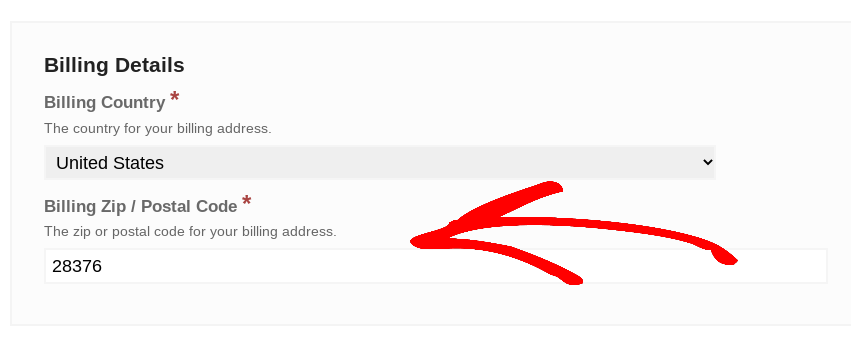

This feature, introduced with EDD version 3.1.1, includes IP location detection support at checkout. In other words, the checkout page on your store/browser will automatically detect and populate the Billing Zip/Postal Code field on the checkout form:

This means the taxes are automatically applied based on the location of the customer (if applicable).

VAT & Reporting Tips/Tools

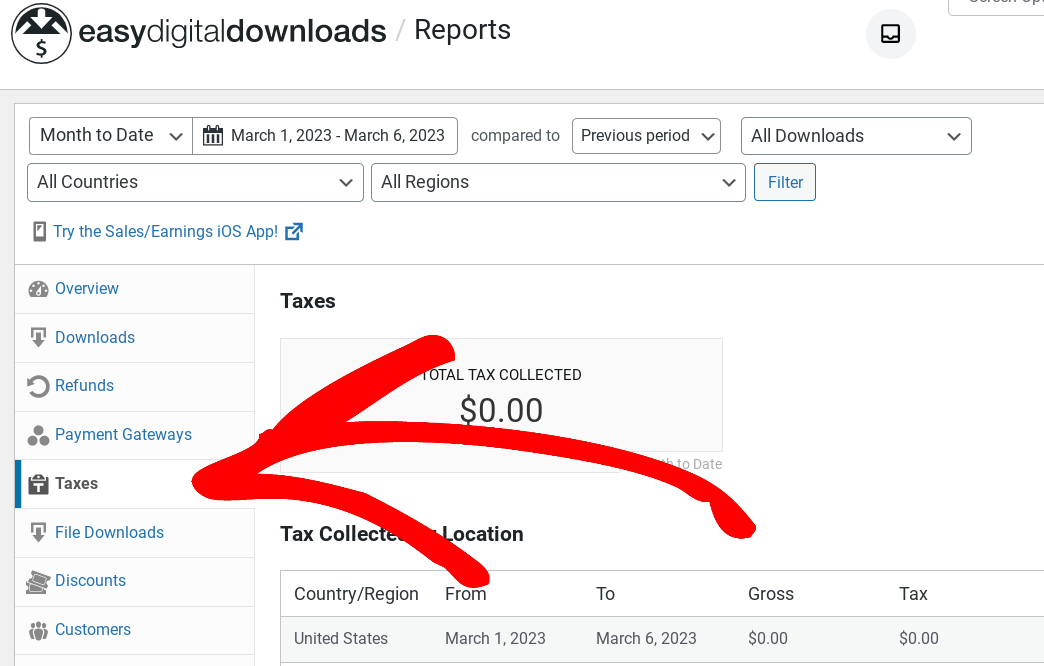

EDD has built-in reporting tools to collect, manage and report data from your store. To locate them, navigate to Downloads » Reports:

You can export these reports as CSV files.

To gather VAT numbers and manage VAT reporting, I recommend checking out the following extensions.

- EDD Invoices

- VAT for Easy Digital Downloads adds complete VAT support to EDD stores.

Additionally, you might consider using Quaderno, which is a tax management platform optimized for Easy Digital Downloads.

FAQs About Automated Tax Calculation in WordPress

Can I use the EDD tax feature if I’m not US-based?

Yes, you can use the EDD tax feature regardless of your location. You’ll need to specify the tax rate for the region you’re selling to.

Can I use EDD for WooCommerce tax calculations?

No, Easy Digital Downloads is a separate eCommerce plugin from WooCommerce. While both plugins can be used to sell digital products, they have different features and functionalities. The

EDD tax feature is only available for use with EDD and cannot be used for tax calculations in WooCommerce. If you’re using WooCommerce, you’ll need to use a different tax calculation tool or plugin.

How accurate is the tax calculation with EDD?

EDD uses geolocation to determine the customer’s location and calculate the tax rate accordingly. It’s accurate in most cases, but there may be some instances where the tax rate is inaccurate due to incorrect geolocation data or other factors.

Do I need to do anything else besides setting up the tax rates?

Once you’ve set up the tax rates in EDD, the system will automatically calculate and add the tax to the customer’s order. You don’t need to do anything else.

Can I disable the tax feature if I don’t want to use it anymore?

Yes, you can disable the tax feature at any time in EDD by simply unchecking the “Enable Tax” option in the Tax Settings page.

Get EDD for Free Automated Tax Calculation in WordPress

While there are many premium tax calculation tools available, not all can afford them. Easy Digital Downloads offers a FREE feature that automatically calculates and collects tax based on the customer’s location, saving money for users.

By following the steps outlined in this article, you can easily set up automated tax calculation in WordPress. Download EDD today to get started!

That is our promise. Most eCommerce solutions limit your creativity

…not Easy Digital Downloads!

📣 P.S. Be sure to subscribe to our newsletter and follow us on Facebook or Twitter for more WordPress resources!