Do you want to accept credit card payments for digital products on your website?

Selling digital products is an entirely online process – there’s no physical inventory, exchange of cash, or shipping of physical goods. And when it comes to digital product sales, the vast majority of transactions are made with credit cards.

So it’s important to have a seamless way to accept online payments through your WordPress site.

🔎 In this article, I’ll cover:

Why Accept Credit Card Payments?

When was the last time you heard of someone mailing a check for an eBook? 🙂

In the simplest terms, you can’t run a digital product store without accepting credit card payments. Offering your shoppers multiple payment options, including debit card payments, credit card payment options, digital wallet payments, etc., is smart.

Accepting credit card payments for your eCommerce store can lead to:

- Increased sales: Credit cards are the preferred payment method for many online shoppers. Offering this option removes a barrier to purchase and increases your customer base.

- Improved convenience: Credit card payments are fast, secure, and convenient for customers, leading to a smoother checkout experience.

- Subscription options: Accepting credit cards allows you to offer recurring subscriptions for ongoing revenue generation.

Overview of Payment Processing

Before getting into choosing a payment processor, let’s cover the basics of accepting credit card payments for digital products!

Choosing the right system to manage your online transactions is one of the most fundamental parts of accepting credit card payments, and it’s a decision that affects your entire business. But, with so many different factors to consider, it’s no wonder that it can feel a bit…daunting.

So, how do you even begin to make the decision? What is a payment processor vs. a payment gateway anyway?

Payment Processing Terminology

| Payment gateway | The technology, software, or tool that securely communicates the payment data (and the approval or decline of the credit card transaction) to the payment processor. In other words, a digital point-of-sale terminal that is used to accept payments for digital goods and services. |

| Payment processor | The company that facilitates/executes the transaction. Payment processors transmit data between the customer and the merchant, as well as the customer’s bank (issuing bank) and the merchant’s bank (acquiring bank). |

| Customer | The individual making the credit card purchase. |

| Merchant/merchant account | The entity being purchased from./A bank account for businesses that want to accept credit card payments. |

| Acquiring bank | The merchant’s bank / the financial institution that receives the payment information and sends it to the issuing bank, requesting funds. Also known as the acquirer or merchant bank. |

| Issuing bank | The customer’s bank/credit card provider / the financial institution that transfers the requested funds to the acquiring bank. Also known as the issuer or consumer bank. |

| Payment authorization | The process of determining if the issuing bank has sufficient funds and approving or declining the credit card transaction. |

| Clearing | The process of transmitting the payment data from the acquiring bank to the issuing bank, calculating any transaction fees, and converting transaction amounts into required currencies. |

| Settlement | The process of calculating and transmitting the final cleared transaction data and transferring the funds from the issuing bank to the acquiring bank. |

| Chargeback | A process initiated when the customer files a dispute with the issuing bank over a suspected fraudulent or invalid purchase, resulting in a fee that must either be accepted and paid by the merchant, or disputed. |

How Credit Card Purchases Work

Every credit card transaction involves the customer, the merchant, the issuing bank, and the acquiring bank.

- The customer submits their payment information to you (the merchant) via the payment gateway using their credit card. 💳

- The payment processor securely transmits this payment data to the issuing bank for authorization, requesting the appropriate funds. 🏦

- Once the payment is cleared, these funds are transferred from the issuing bank to the acquiring bank, and the transaction is settled. 💰

In order to accept credit card payments, you’ll need a payment gateway/processor that facilitates transactions between these parties.

Choosing a Payment Processor

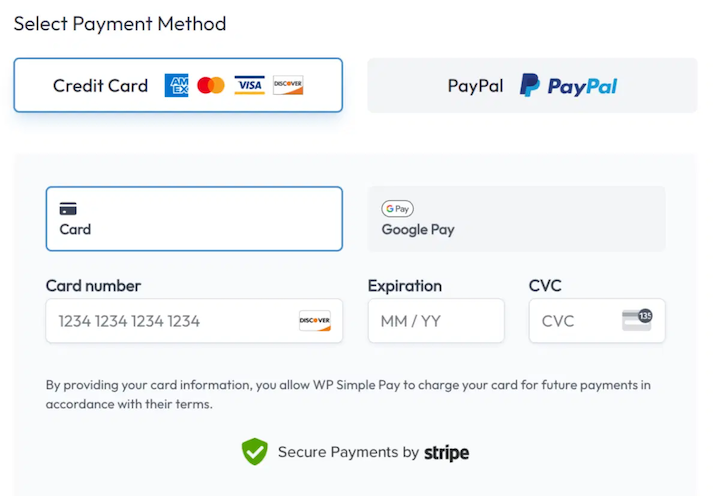

Stripe and PayPal are the most widely recognized payment processors worldwide.

A variety of other options exist (like Square, 2Checkout, and Authorize.net, for example), but Stripe and PayPal are the true industry standards.

They offer the most streamlined checkout experiences, support for digital products, and other handy eCommerce features like the ability to accept subscription payments.

It’s easy to sign up for a Stripe or PayPal business account. All you have to do is enter your personal details and verify your bank account to get up and running. Once your account is confirmed, you will have access to a variety of tools to manage transactions on your digital product store, all within one organized central platform.

Stripe is also known for having an attractive and minimal interface, more flexibility, and high-quality documentation for developers that makes customization a breeze.

Stripe vs PayPal: Fees & Features Compared

One of the biggest factors in choosing a payment processor is the fees associated with transactions. Digital product stores tend to be unique in that products are easily distributed worldwide, compared to physical products, which require import/export fees, international shipping costs, etc.

As we discussed in our post about the digital product purchase process, Stripe and PayPal have some notable differences in fees when it comes to international transactions. As you can see in the chart below, PayPal charges a significantly higher fee for transactions outside the U.S. with fewer currencies supported compared Stripe.

However, PayPal business accounts are available in more countries than Stripe. It also has a long-standing reputation for security, buyer protection, and seamless use on different devices.

The right processor for you depends on your specific business needs and preferences.

| PayPal Business Account | Stripe | |

| Pricing within the U.S. | 2.9% + $0.30 per transaction | 2.9% + $0.30 per transaction |

| Pricing outside the U.S. | 4.4% + fixed fee per transaction | 2.9% + $0.30 per transaction |

| Currencies supported | 200+ | 135+ |

| Countries available | 25 | 25 |

| Digital products protected | No | No |

| Digital services protected | No | No |

| Account management | Yes | Yes |

| Volume discounts | Yes | Yes |

| Dedicated support | Yes | Yes |

| Migration assistance | Yes | Yes |

| Balance transfers (bank account) | Free | Free |

| Balance transfers (debit card) | 1% of amount transferred | No |

| Currency conversion | 1-4% per transaction | Varies per transaction |

| Card authorization | $0.30 | Free |

| Fraud tools | Yes | Yes |

| Advanced fraud protection | $10 per month + $0.05 per transaction | Free |

| Dispute/chargeback fee | $20 | $15 or $0 |

| Embedded checkout | Yes | No |

| Hosted checkout | Yes | Yes |

| Custom invoices | Yes | Yes |

| Buyer protection for digital products | Yes | Yes |

| Seller protection for digital products | No | No |

| Tools, reports, and analytics | Yes | Yes |

| Apple Pay | No | Yes |

| Google Pay | No | Yes |

| Bitcoin | No | No |

| E-checks | No | Yes |

| API integrations | Yes | Yes |

| ACH | No | Yes |

| AliPay | No | Yes |

| Company loans | Yes | Yes |

| Split/adaptive payments | Select partners only | Yes |

| Mass payments | Yes | No |

International Transactions

When consumers make purchases across country borders, they tend to be on higher alert for anything risky, suspicious, or seemingly illegitimate. So, if you want to sell to customers worldwide (as most digital product sellers do), you’ll want to take this into account.

Some international shoppers might even abandon their carts altogether if they aren’t convinced that you’re going to process their payment data securely, or if they can’t pay in their preferred currency. The good news is that PayPal and Stripe both allow payments to be made in the customer’s local currency.

Customer Confidence

Customer confidence is essential when it comes to actually converting digital product sales. There are ways to make sure your customers feel comfortable using their credit cards on your site.

Visual trust cues like site security badges, SSL certificates, and payment gateway logos are basic elements that help customers have that extra sense of security they need to trust you with their sensitive data.

It’s also worth considering making improvements to your social proof, social media presence, and brand visibility.

All of these things combined contribute to giving customers the confidence that your brand is trustworthy and that their credit card information will be safely used if they decide to buy your products.

Fraud Concerns

Unfortunately, fraud affects a significant portion of digital businesses that accept credit card payments, large and small. Some estimates suggest that 50% of all small businesses experience fraud at some point – and with digital products, it’s no different.

When fraudulent orders come in, it can be frustrating as a digital product creator and store owner. Not only do you have to deal with the loss of revenue that comes from refunding the order.

Payment processors also charge you extra fees when customers initiate chargebacks (some of which can be $30 or more) on suspicious orders.

To top it off, if you get too many chargebacks, you also risk losing your Stripe or PayPal business account.

So, what are you supposed to do? To some degree, fraud comes with the territory. If you want to run a thriving digital product store, you’ll likely encounter it at some point.

However, there are measures you can take to protect yourself, your company, and your customers against fraud.

Credit Card Payments: Fraud Prevention Tips

- Use fraud detection plugins like FraudMonitor.

- Monitor customer transactions every day.

- Make sure that the IP address where the purchase was made matches the IP address where the product was downloaded.

- Check customer account information for obvious misspellings, profanity, or fake names.

Fraudulent orders are often cases of identity theft, where people make purchases with stolen credit card information. But they can also be cases where perpetrators gain access to customer login details and take over accounts via phishing or similar tactics.

In addition to taking the proactive measures listed above, payment gateways like PayPal and Stripe will usually alert you if something looks unusual (in the case of identity theft). But when it comes to account takeovers, the best thing you can do is use standard site security practices.

Which brings us to…

Site Security

Accepting credit card payments online comes with a higher level of responsibility. After all, you’re handling sensitive personal data that could end up being detrimental to the well-being of your customers if compromised.

While it’s true that no online store is ever 100% protected against malicious forces, you can reduce your risk as much as possible. When it comes to the nature of fraudulent orders, here are a few practical steps you can take to make customer accounts less vulnerable:

- Require strong passwords. Long, randomly generated passwords with a mixture of numbers, letters, and special characters are harder for perpetrators to guess. Require strong passwords, or encourage customers to adopt these methods when signing up for your site.

- Use two-factor authentication. If you can, add two-factor authentication to your customer login process so that they are notified of any unusual login attempts, and protected against brute force attacks.

- Consider doing away with customer accounts altogether. If you don’t absolutely need customer accounts, consider not using them at all. This reduces the risk of account takeovers to about zero.

Accepting Credit Card Payments With Stripe

Easy Digital Downloads (EDD) empowers you to sell digital products on your WordPress website. It also integrates with several payment gateways that allow you to seamlessly accept secure credit card payments, boosting your online revenue.

I highly recommend Stripe.

Learn more about setting up Stripe for your online store.

Use EDD for Accepting Credit Card Payments

While it comes with its own set of risks and complications, accepting credit cards is a must when it comes to selling digital products.

Understanding how credit card payments work helps you choosing the right payment processor for your needs.

If you don’t have Easy Digital Downloads yet, grab your pass and get your payment gateways set up within minutes:

📣 P.S. Be sure to subscribe to our newsletter and follow us on Facebook or Twitter for more WordPress resources!