Are you trying to figure out how to collect eCommerce sales tax for your online store?

Sales tax can be a complex area for businesses. But it’s important to address it before making any online sales. Staying up-to-date with changes in eCommerce sales tax regulations helps ensure your business remains compliant and your customers aren’t overpaying for their purchases.

The good news is that there are simple steps you can take to collect eCommerce sales tax in WordPress.

🔎 In this article, we’ll cover:

What Is eCommerce Sales Tax?

If you’re unfamiliar, eCommerce sales tax is a tax that online stores must charge when selling something to customers in the same state. The amount of the eCommerce sales tax charged depends on the customer’s shipping address and whether the state requires it.

For example, if a customer purchases goods from your online store and has them shipped to California, you must collect a 7.25% sales tax for that purchase. It is important to note that these laws can vary by state and may also be subject to additional local taxes or fees.

ECommerce sales tax doesn’t only apply to physical goods, either. Digital product taxes are also required in some cases.

Why eCommerce Sales Tax Is Important

Many states have adopted laws requiring online retailers to collect taxes for any sale made within the state boundaries, regardless of where the business is located. This means that if an online retailer makes a sale in California, they must collect a sales tax from the customer unless otherwise exempt. Failure to correctly collect and remit eCommerce sales taxes can result in penalties or fines from the state’s taxation department.

To ensure you meet sales tax compliance requirements for the sales tax laws in each state, it’s important to understand your responsibilities as an online retailer. You may need to register with the state’s department of taxation, collect and remit taxes on any transactions made within that state, and file sales tax returns periodically.

Additionally, you will want to make sure that your customers are aware of the applicable eCommerce sales taxes before they complete a purchase. By understanding the tax collection regulations and requirements in each state, you can ensure that your store’s tax processes remain compliant and avoid costly penalties or fines.

➡️ Do you sell digital products to consumers in the European Union (EU)? Check out our guide on EU VAT for Easy Digital Downloads: What You Need to Know.

How to Collect eCommerce Sales Tax in WordPress

Ready to get started? In this step-by-step tutorial, I’ll walk you through collecting eCommerce sales tax in WordPress for digital products.

Step 1: Get Easy Digital Downloads

If you already use Easy Digital Downloads (EDD), feel free to jump to the next step. Otherwise, the first step is to download and install EDD on your WordPress site:

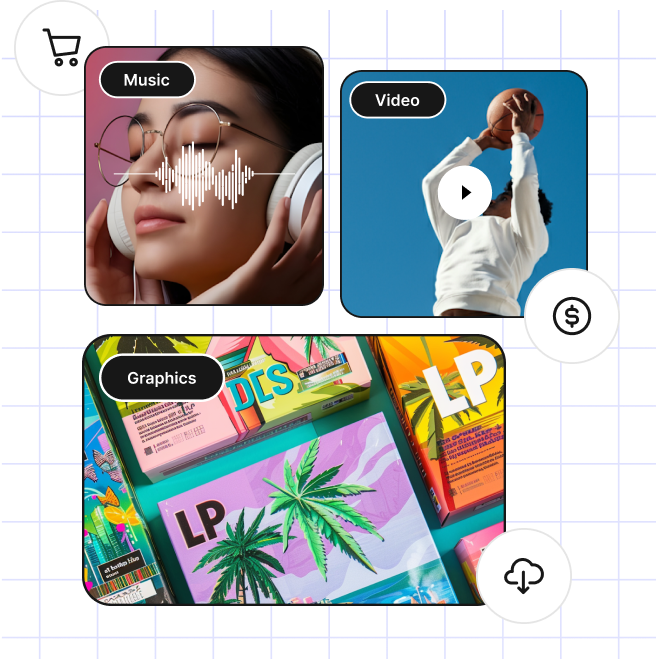

EDD is a complete eCommerce solution. The WordPress plugin is the ideal tool for creating an online store and selling digital products. It’s an ideal WooCommerce alternative if you don’t offer any physical products.

Collecting eCommerce sales taxes in WordPress with EDD is easy. It has built-in tools for charging various tax rates based on your customers’ locations.

You can easily enter the applicable sales tax rates for each state or region you’re selling to. Then you can automatically collect those taxes on every purchase. Additionally, using EDD makes it easier to track how much money you owe for sales taxes and file returns or tax reports as needed.

First, head over to the EDD website pricing page and select your plan or click below to get started:

eCommerce without limits!

That is our promise. Most eCommerce solutions limit your creativity

…not Easy Digital Downloads!

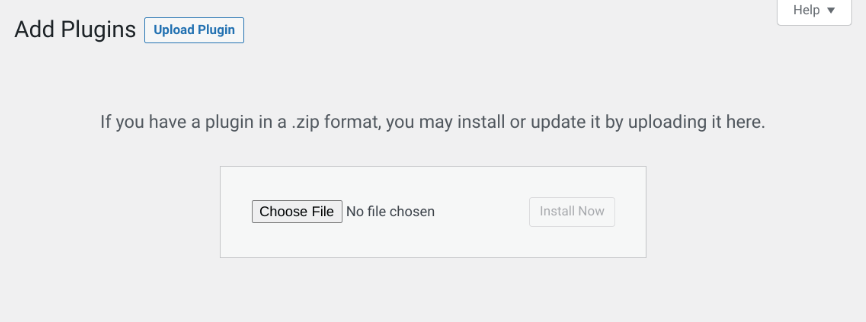

Then you can download the plugin’s zip file and upload it to your site (Plugins » Add New » Upload Plugin):

Next, select Install Now then Activate Plugin.

We won’t go in-depth about setting up your online store or the basic EDD settings. For more on this topic, you can use these guides:

Step 2: Enable & Configure eCommerce Sales Tax

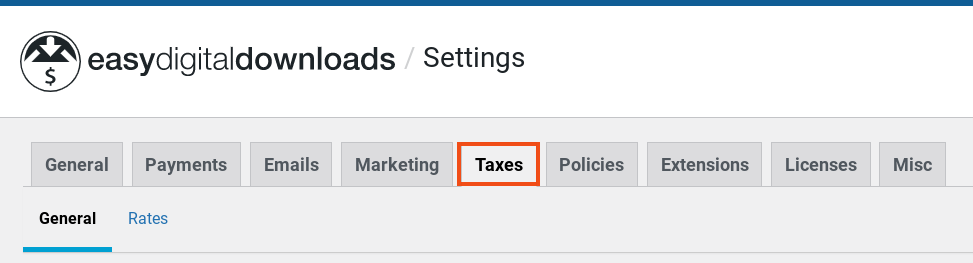

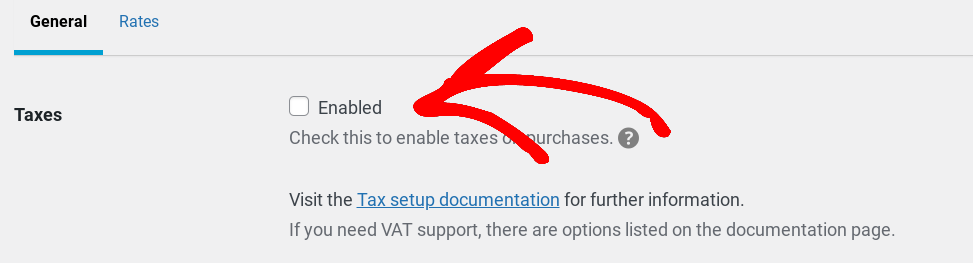

After you’ve completed the initial setup, like adding a payment gateway and entering your basic business info, you can move on to the tax settings. First, go to Downloads » Settings » Taxes:

Click on the Enabled checkbox next to Taxes to enable taxes on purchases:

When applicable, EDD will require shoppers to enter their address at checkout so that the eCommerce sales tax calculations apply accordingly.

General Tax Settings

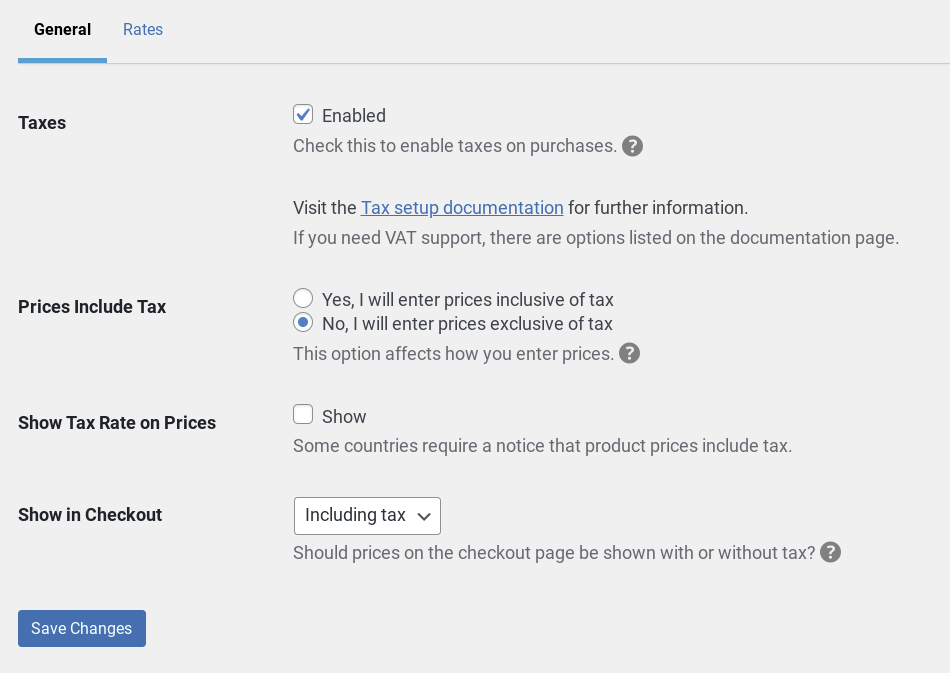

After you enable taxes, there is a handful of simple sales tax rules you can configure for purchases:

First, you can decide whether to include taxes in your total price displayed to customers on the product page. If you select No, the tax amounts won’t be calculated and added to the product prices until checkout.

You can also enable the Show Tax Rate on Prices option. This displays the amount the customer is expected to pay in taxes below the purchase buttons.

Additionally, under the Show in Checkout dropdown menu, you can decide whether prices on the checkout page are shown with or without tax. For instance, let’s say you have a $20 product with a 10% tax. If you set it to Including Tax, the product will be shown to customers as $12.

When you’re done, click on Save Changes.

Step 3: Add Tax Rates for Specific Locations

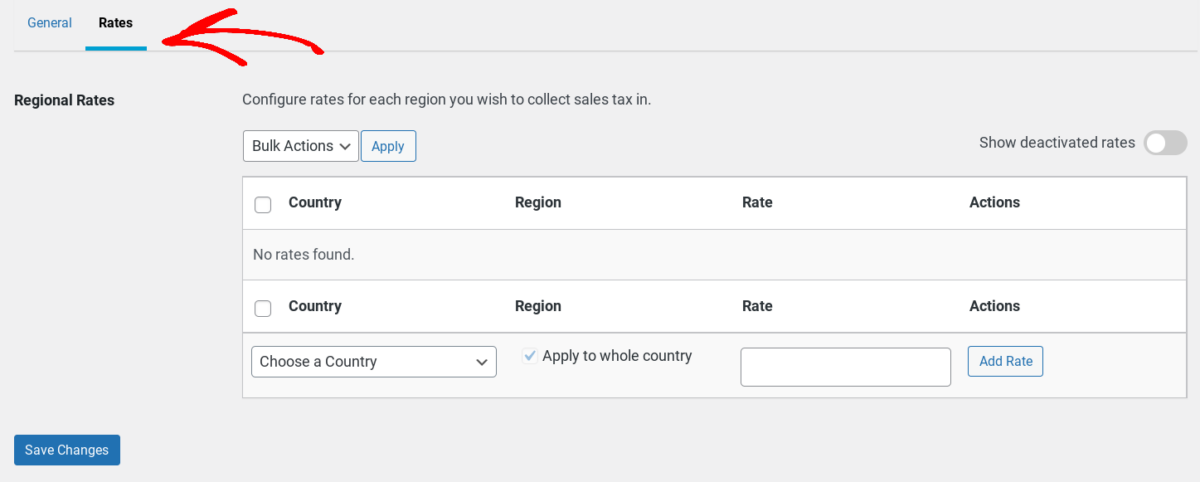

Next, you can configure rates for each region you want to collect eCommerce sales tax in. To do this, navigate to Rates under the tax tab:

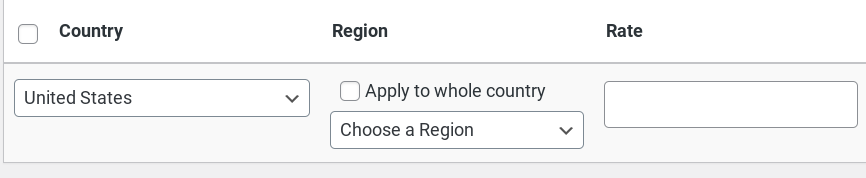

You can click on the Choose a Country dropdown menu to select an option:

Then you can select Apply to whole country. This setting is selected by default. If you only want to apply the tax to specific areas, you can uncheck the box, then click on Choose a Region.

You can enter the tax rate in the Rate text field, then click on the Add Rate button.

Note that the rates you add can be Deactivated (but not deleted). Also, you can’t update the rates you add. To change it, you would need to deactivate the rate, then add a new one.

⚙️ For more details on EDD tax settings, you can refer to our documentation.

Additional EDD eCommerce Sales Tax Tools

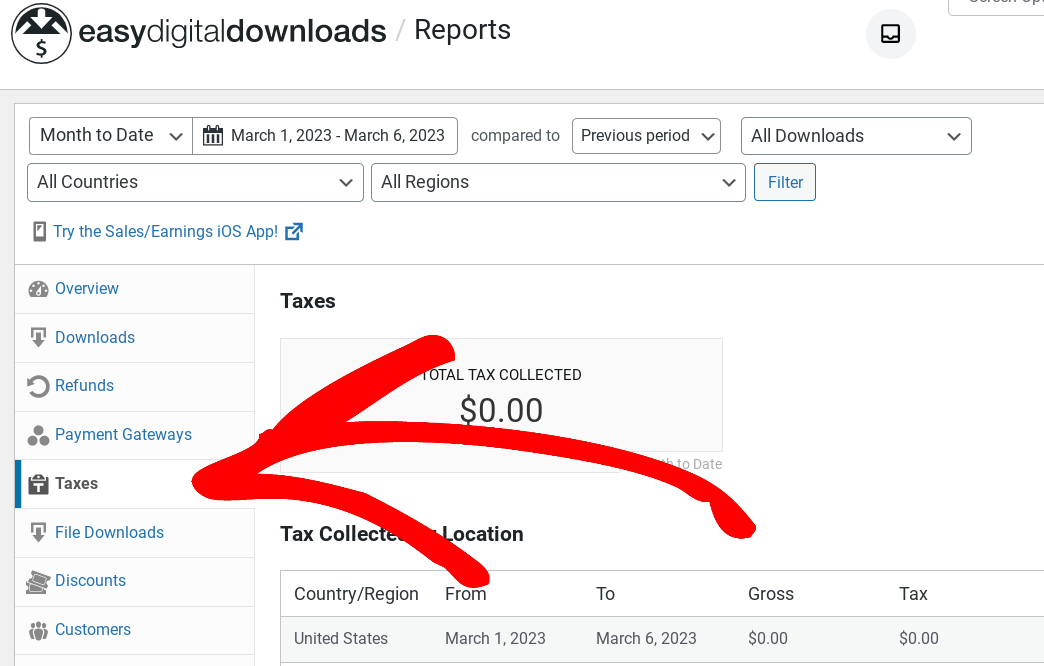

Easy Digital Downloads has built-in reporting and analytics tools that help you collect, manage and report data from your online store. In addition to Gross and Net earnings, you can go to Downloads » Reports to find the amount collected that needs to be paid in taxes:

You can also export this data into CSV files.

If you need to gather VAT numbers and handle VAT reporting, there are a few extensions that can help simplify the process.

- EDD Invoices provides customers with the option to generate and download invoices that include both the store and customer VAT numbers.

- Easy Digital Downloads EU VAT can help online sellers meet European tax laws. You can use it to charge customers the correct tax rates automatically. It’s also incredibly useful for the validation of VAT numbers, reversing VAT charges for businesses, and providing EU-compliant tax invoices.

- VAT for Easy Digital Downloads adds complete VAT support to EDD stores.

Finally, you might consider using Quaderno. This is a powerful tax management platform optimized for Easy Digital Downloads.

FAQs About eCommerce Sales Tax

How do you calculate eCommerce sales tax?

The sales tax rate for online purchases is usually based on the buyer’s shipping address. Some states also require the collection of local or county taxes and state taxes.

There are WordPress plugins and tools that can help make calculating sales tax easier. The best option depends on the type of online business/eCommerce platform you have. For instance, if you own a WooCommerce store, some specific settings and plugins automate WooCommerce tax. Alternatively, if you use EDD to run your eCommerce business, there’s built-in functionality for configuring tax options and sales tax calculations.

Do you need to collect tax for digital products?

This depends on the regulations of the state in which you are selling. Some states may require that sales tax be collected for digital products, while others may not. It is important to research your specific state laws to determine if and when you need to collect taxes for digital goods.

What’s the difference between eCommerce & traditional sales tax?

An eCommerce sales tax is a type of tax that applies to online purchases. This type of tax is based on where the purchaser resides rather than the location of the business selling the goods or services. It helps states and municipalities collect revenue from customers who may not have a physical presence in their jurisdiction but still purchase goods or services from them.

Alternatively, traditional sales tax is a tax that applies to purchases made in physical stores. This type of tax requires businesses to collect and remit taxes based on the state or local jurisdiction where their business is located and not necessarily where the customer resides. In both cases, taxes are collected by businesses and remitted to relevant government agencies.

Use EDD to Automate eCommerce Sales Tax

Using an automated solution such as EDD can help minimize the stressful admin work associated with collecting online sales taxes, while also ensuring that the appropriate amount is collected and paid. EDD’s flexible reporting can help you easily review your sales tax data to make informed decisions.

Are you ready to automate your eCommerce sales tax processes? Download Easy Digital Downloads to get started!

eCommerce without limits!

That is our promise. Most eCommerce solutions limit your creativity

…not Easy Digital Downloads!

📣 P.S. Be sure to subscribe to our newsletter and follow us on Facebook or Twitter for more WordPress resources!