Running an online business requires a seamless and secure way to accept payments — which is where payment gateways come in. But what is a payment gateway, and how does it work with WordPress sites?

This comprehensive guide will break down everything you need to know, from the basics to choosing the right gateway for your EDD store.

🔎 In this article, I’ll cover:

What Is a Payment Gateway?

In eCommerce, there are several fundamentally important aspects of the online store. One of the most important is accepting payment from customers for the goods or services you offer.

The system through which the payment is processed is often called a payment gateway. But what is a payment gateway? This label describes the system that handles the transfer of money from the customer to the store owner.

In other words, a payment gateway acts as the crucial bridge between your online store and your customer’s bank or credit card.

Think of it as the online equivalent of a point-of-sale terminal in a physical store.

Its primary function is to securely transmit transaction information between the customer, your store, and the payment processor.

Without a payment gateway, you simply can’t accept credit card payments or other types of online payments, making it a fundamental component of any successful EDD setup.

Benefits of Using a Payment Gateway

Aside from handling the transaction processing, a payment gateway has several other important functions.

Streamlined Payment Processing

Payment gateways automate payment collection and reconciliation. They make the handling of payments simpler and easier to set up.

Before services like Stripe, PayPal, and Authorize.net were available, setting up a merchant account to process credit and debit card payments was a difficult, long, and labor-intensive process. Now it’s as simple as registering an account and connecting it to your eCommerce website with a few simple settings.

Increased Sales

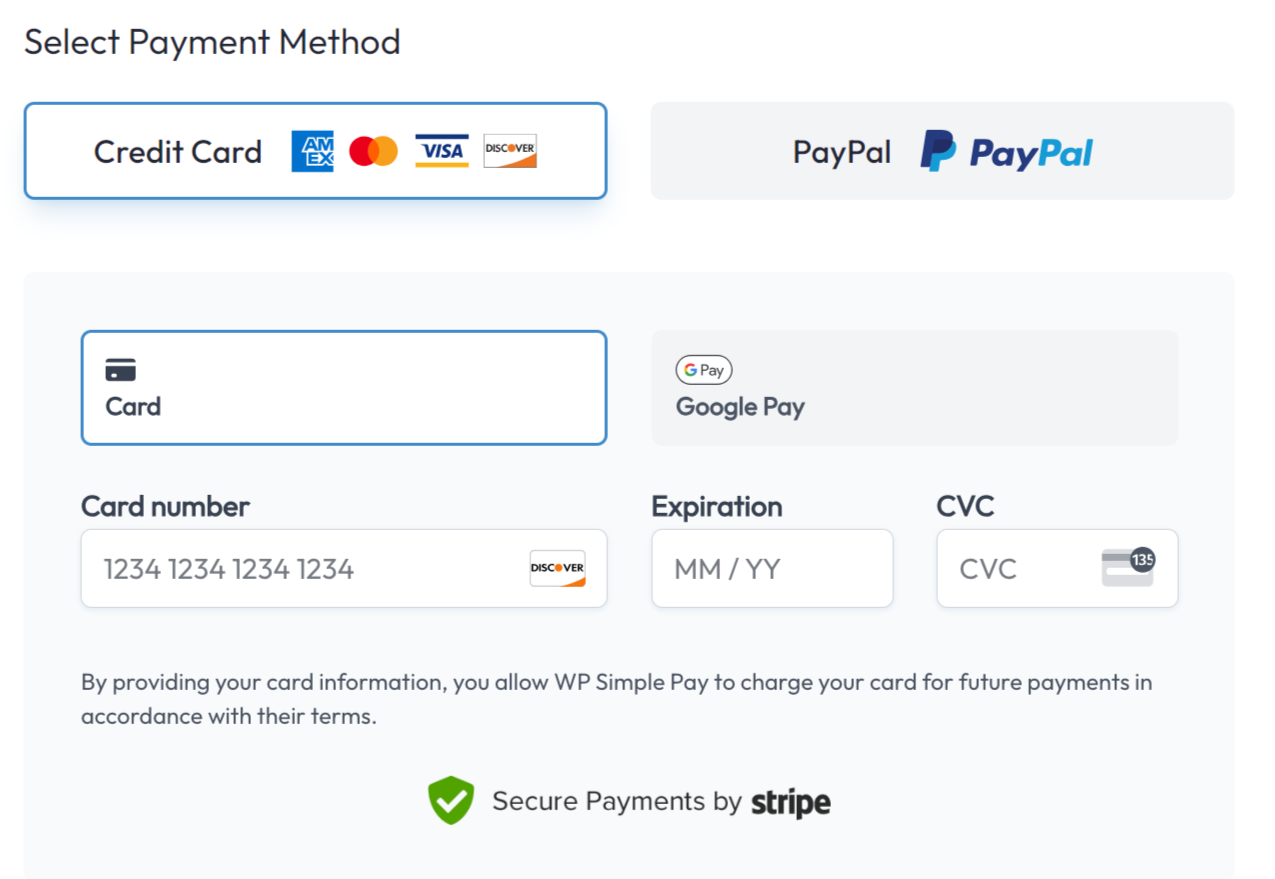

Offering multiple payment options increases conversion rates. Payment gateways like Stripe make it easier to offer various popular payment methods on your eCommerce site. You can reach a wider audience and drive more conversions than you’d otherwise be able to.

Payment gateways improve the customer experience. A smooth and secure checkout process enhances customer satisfaction.

Enhanced Security

Payment gateways protect your business and your customers from fraud. They are designed to keep customers’ information confidential and secure.

In the best payment gateways, the customer’s payment information (credit card number and details, for example) never touches the website’s server nor is the information made available to the eCommerce store’s owner. The information is kept safe, secure, and confidential.

How Payment Gateways Work

Understanding the mechanics of a payment gateway can seem daunting, but it’s a straightforward process.

In simple terms, a payment gateway system works behind the scenes to accept the payment from a customer and then facilitate the transfer of funds to the store owner’s bank account.

The typical process looks like the following.

- Customer Checkout: The customer adds a digital product to their cart on your online store and proceeds to checkout.

- Payment Information: They enter their payment details (credit card number, expiration date, etc.) on your checkout page.

- Secure Transmission: Your eCommerce plugin securely transmits this sensitive information to the payment gateway. This is where the gateway’s security features (like encryption) become vital.

- Authorization Request: The payment gateway sends an authorization request to the customer’s bank or card issuer through the payment processor.

- Approval/Decline: The bank verifies the customer’s funds and approves or declines the transaction.

- Transaction Response: The payment gateway relays the response back to your store.

- Order Confirmation: If approved, your store processes the order, delivers the digital product to the customer, and notifies you of the successful sale.

- Funds Settlement: The payment processor transfers the funds from the customer’s bank account to your merchant account.

Types of Payment Gateways With Examples

While the core function remains the same, payment gateways come in different flavors. Below are the most common types of payment gateways you might encounter when setting up your online store.

Hosted payment gateways redirect customers away from your site to the payment gateway’s secure server to complete the transaction. This simplifies PCI DSS compliance for you, as the sensitive data is handled entirely by the gateway. PayPal Standard is a classic example.

Integrated payment gateways allow customers to complete the entire checkout process on your eCommerce site without being redirected. This provides a more seamless and branded experience. Stripe and Authorize.net are popular examples.

Redirect payment gateways, similar to hosted gateways, redirect customers to a third-party page. But they’re often for specific payment methods like Alipay or Sofort.

Choosing a WordPress Payment Gateway

Nearly every online store requires a payment gateway to process payments. But not every business has the same requirements or factors to consider. Choosing an online payment gateway can be one of the most important decisions you make when setting up your store, so it is important to consider the payment gateway options carefully.

Below are some key aspects to consider when researching, comparing, and choosing a WordPress payment gateway.

Your eCommerce Solution

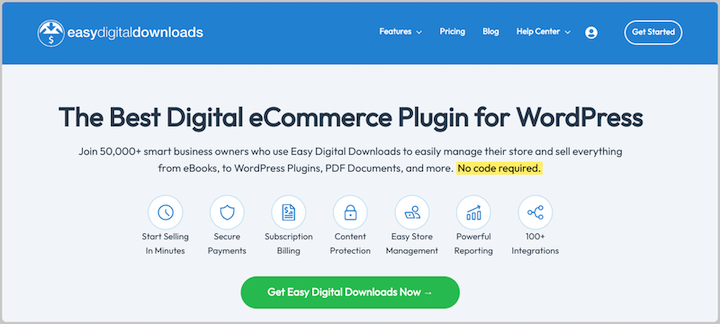

If you’re using WordPress to create an online store, the two most popular eCommerce plugins to use are WooCommerce (physical products) and Easy Digital Downloads (digital products).

Most WordPress eCommerce plugins offer built-in support for Stripe and/or PayPal. However, additional payment gateways and options available may depend on your plan or license.

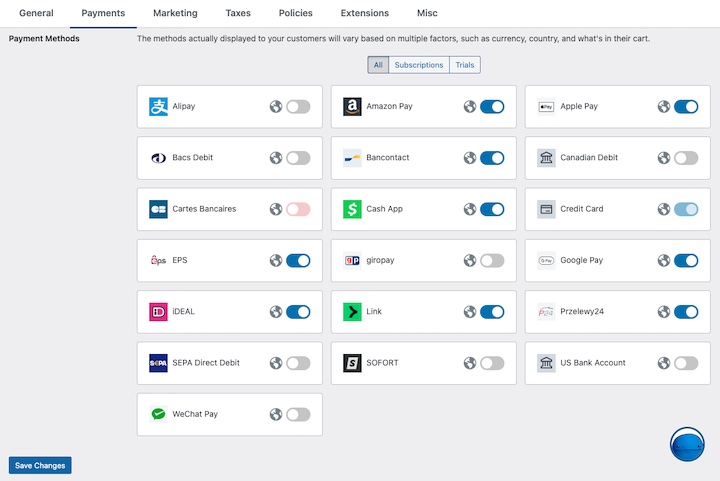

For instance, EDD Pro users have access to a wide range of payment gateway integrations via Stripe.

Supported Payment Methods

Ensure the gateway supports the payment types your customers prefer. Some popular options include:

- Debit and credit cards

- Digital wallets like Apple Pay and Google Pay

- Buy now, pay later (Klarna, Afterpay)

- ACH/Bank transfers

Does it support all necessary billing features needed for your business model? For instance, consider whether you need to support one-time transactions, recurring payments, pre-authorized charges, etc.

Don’t forget to consider scalability.

Choose a gateway that can grow with your business. If you plan to sell internationally and want to accept global payments online, choose an international payment gateway that supports multiple currencies.

Payment Processing & Transaction Fees

How do the credit card processing fees compare to other gateways? Be aware of the various fees and charges associated with payment gateways. These could include:

- Transaction fees: A percentage of each transaction.

- Monthly fees: A recurring charge for using the gateway.

- Setup fees: A one-time fee for setting up your account.

- Chargeback fees: Fees incurred when a customer disputes a charge.

For example, Stripe typically charges a 3% transaction fee. However, Easy Digital Downloads paid plans allow Pro users to eliminate this fee.

💡 Learn more about Easy Digital Downloads Free vs Paid plans.

Security & Fraud Prevention

Paramount for protecting sensitive customer data. Ensure the gateway is PCI DSS compliant. Tools to detect and prevent fraudulent transactions are essential.

For example, integrating Easy Digital Downloads with Stripe lets you leverage its Early Fraud Warning alerts. This helps prevent chargebacks—and the associated fees.

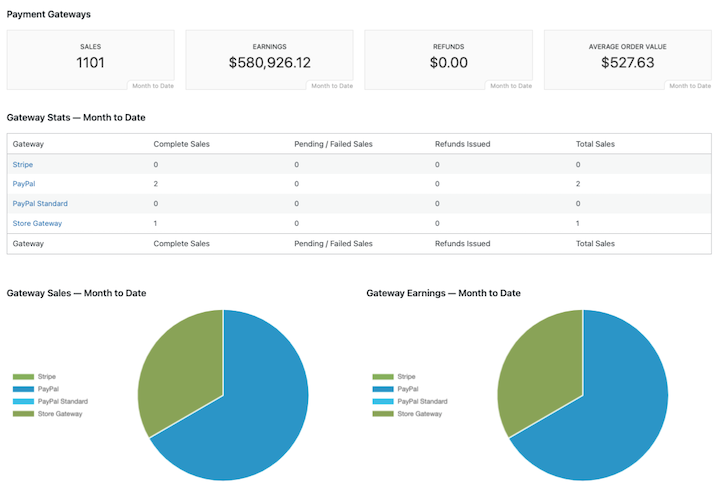

Integration & Reporting

Any gateway you use should integrate seamlessly with your WordPress site to deliver an optimized checkout experience. In addition to your eCommerce plugin like EDD, this should also include other WordPress plugins or tools you’ll use to manage and maintain your store.

For instance, consider reporting tools. Access to detailed transaction reports helps you manage your finances effectively.

The payment landscape is constantly evolving. Mobile payments, contactless payments, and biometric authentication are becoming increasingly popular. Choosing a flexible and forward-thinking payment gateway will ensure your online store remains competitive in the years to come.

My Payment Gateway Recommendation

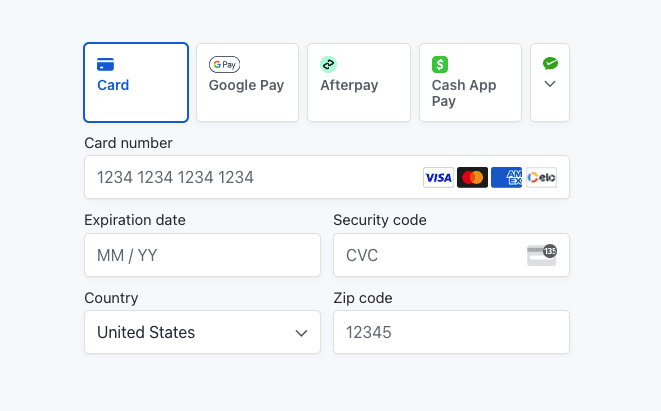

I’ve worked with a variety of payment gateways over the years. When it comes to running an online store and selling products online, especially digital products, you can’t go wrong with Stripe.

In my experience, Stripe has an ideal combination of security, usability, and versatility. It’s free to create an account. It’s also one of the most widely accepted across the globe.

One of Stripe’s standout features is Link. It makes it incredibly easy for its users to save payment details so they can automatically apply them to future purchases without having to re-enter all the information. It saves time and streamlines the checkout process intuitively and securely.

Using Easy Digital Downloads? The Core EDD plugin supports Stripe out of the box. However, I highly recommend upgrading to an EDD Pro pass to unlock all of Stripe’s features and functionality.

You can eliminate transaction fees and integrate dozens of additional payment methods directly from your WordPress dashboard.

💡Learn more about integrating Stripe payment options with EDD.

| Stripe Feature | Free | Personal | Extended | Professional | All Access |

|---|---|---|---|---|---|

| All Payment Methods | ✅ | ✅ | ✅ | ✅ | ✅ |

| Fraud Warnings | ✅ | ✅ | ✅ | ✅ | ✅ |

| Subscriptions | ❌ | ❌ | ✅ | ✅ | ✅ |

| Pre-Sale Support* | ❌ | ❌ | ✅ | ✅ | ✅ |

| Additional Fees | 3% per transaction | 3% per transaction | 0%** | 0%** | 0%** |

If Stripe isn’t supported in your country or you’re looking for an alternative, I recommend PayPal Commerce.

FAQs Related to What Is a Payment Gateway?

Let’s wrap up with some frequently asked questions surrounding what is a payment gateway and what to expect when using one for your WordPress site.

What is a payment gateway and how does it work?

A payment gateway serves as a bridge between an online store, its customers, and their financial institutions. It enables secure transmission of transaction information during the checkout process.

When a customer enters payment details on a website, the gateway works by encrypting and sending that data to the customer’s bank or card issuer for authorization. Upon approval, the gateway relays the transaction status back to the store, facilitating order processing and delivery of digital products.

What are the benefits of using a payment gateway?

Payment gateways play a vital role in e-commerce by streamlining payment collection, enhancing security, and offering a seamless checkout experience for customers.

What is the difference between a payment gateway and a payment processor?

If you’re wondering ‘what is a payment gateway?’ it’s only a matter of time before you’re wondering the same about payment processors. While often used interchangeably, payment gateways and processors are distinct entities.

- The payment gateway is the technology that facilitates the communication between your store and the payment processor.

- The payment processor is the company that handles the actual transfer of funds between the customer’s bank and your merchant account.

Think of the gateway as the messenger and the processor as the delivery service.

How much do payment gateways cost?

Payment gateway costs vary depending on the provider and the services offered. Typically, gateways charge a combination of transaction fees (a percentage of each sale), monthly fees (a flat fee for using the service), and setup fees (a one-time fee for setting up your account).

Typically, transaction fees range from 2% to 3% per transaction. Monthly fees can vary from $10 to $100 or more. Setup fees are often around $100 but can be higher.

Some gateways may also charge additional fees for features like fraud protection or recurring billing. It’s important to compare the fees of different gateways and choose one that fits your budget and needs.

Integrate Your Preferred Payment Gateways

A well-chosen payment gateway is the backbone of any successful EDD store. By understanding the different types of gateways, their features, and the associated fees, you can equip your small business with a secure and efficient payment processing system, paving the way for increased sales and a seamless customer experience.

Don’t underestimate the power of a good payment gateway – it’s an investment that will pay off for your EDD business.

Want access to the leading payment gateways for eCommerce sites? Grab an Easy Digital Downloads pass and incorporate multiple gateways at no additional cost!

📣 P.S. Be sure to subscribe to our newsletter and follow us on Facebook, Twitter/X, or LinkedIn for more WordPress resources!

Using WordPress and want to get Easy Digital Downloads for free?

Enter the URL to your WordPress website to install.

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.

4 comments

Comments are closed.

I’m grateful for the detailed insight provided here.

This post answered a lot of my questions—thank you!

You’ve done a great job simplifying this concept.

This is a topic I’ve been curious about for a while.