You’ve built your online store, uploaded your products, and you’re ready to launch. But there’s one crucial piece missing. Without it, you can’t make a single sale. I’m talking about a payment gateway.

New online sellers often feel overwhelmed by payment terminology. What’s the difference between a gateway, processor, and merchant account? The fear of choosing the wrong payment solution is real. You might lose sales or compromise security.

Confusion about costs, fees, and integration doesn’t help either. You want to provide customers with secure, seamless checkout experiences. But where do you even start?

🔎 This guide will demystify payment gateways completely. You’ll learn what they are, how they work, the types available, and how to choose the right one for your online business to provide customers with a secure, seamless checkout.

- What Is a Payment Gateway? (Core Definition)

- Why Payment Gateways Matter for Your Online Store

- How Payment Gateways Work: Transaction Journey

- Types of Payment Gateways: Finding Your Fit

- Popular Payment Methods Supported

- How to Choose a WordPress Payment Gateway

- Payment Gateway Mistakes to Avoid

- FAQs about Payment Gateways for WordPress

What Is a Payment Gateway? (Core Definition)

A payment gateway is the technology that connects your online store to the financial world. Think of it as a bridge between your website, your customers, and their banks.

The gateway’s primary function is the secure transmission of payment information. When a customer enters their credit card details on your site, the gateway encrypts that data. It then safely sends it to the appropriate financial institutions for processing.

It’s basically the online equivalent of a point-of-sale terminal in physical stores. Just like that card reader at your local coffee shop, a payment gateway facilitates the transaction. The difference? Everything happens digitally and instantly.

Payment gateways are absolutely essential for any e-commerce operation. Without one, you literally cannot accept online payments. No gateway means no sales.

✖️ What a payment gateway is NOT: It’s not the same as a payment processor or merchant account. I’ll explain those differences in detail later. For now, just know that while related, they serve different functions in the payment ecosystem.

Why Payment Gateways Matter for Your Online Store

Payment gateways offer critical value beyond processing. They impact every aspect of your online store.

Enhanced Security & Trust 🔑

Gateways secure sensitive customer data, keeping it off your server, aiding PCI DSS compliance. They include fraud detection, SSL/encryption, and tokenization. Visible security badges build customer confidence and reduce cart abandonment.

They also lend professional credibility. Recognized payment brands (Stripe, PayPal) build instant trust. Professional, branded invoices and receipts establish your business’s legitimacy and signal reliability through compliance with industry standards.

Streamlined Operations & Automation 🚀

Gateways automate payment collection and reconciliation, simplifying setup versus old merchant accounts. It’s as simple as registering an account and connecting it to your e-commerce site.

They integrate with accounting tools and instantly send confirmations and receipts.

Increased Sales & Conversions 💸

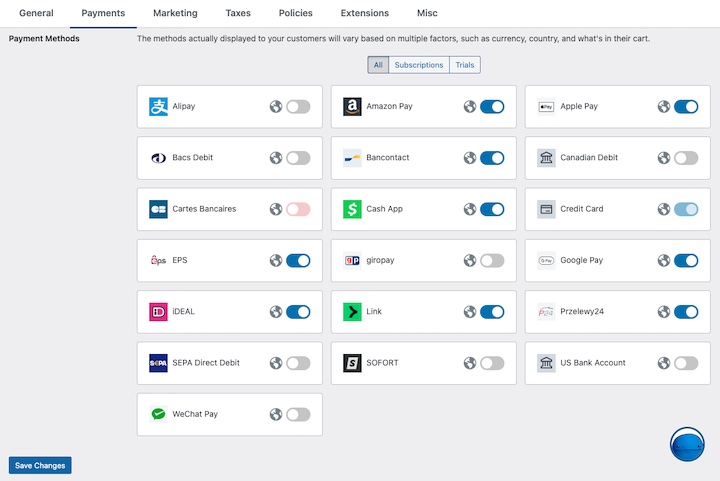

Offering customers multiple payment options boosts conversion rates, and payment gateways make doing that effortless. They support various payment methods (digital wallets, buy-now-pay-later) to reduce lost sales.

Seamless, mobile-optimized checkout and features like one-click purchases minimize cart abandonment and increase repeat sales.

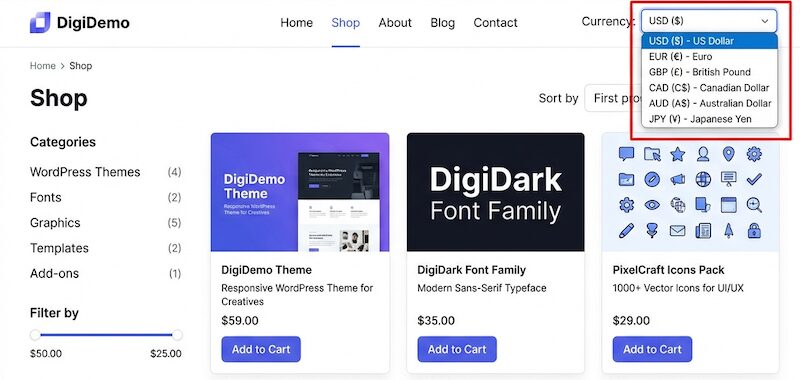

Multi-currency support opens international markets, and guest checkout boosts new customer conversions.

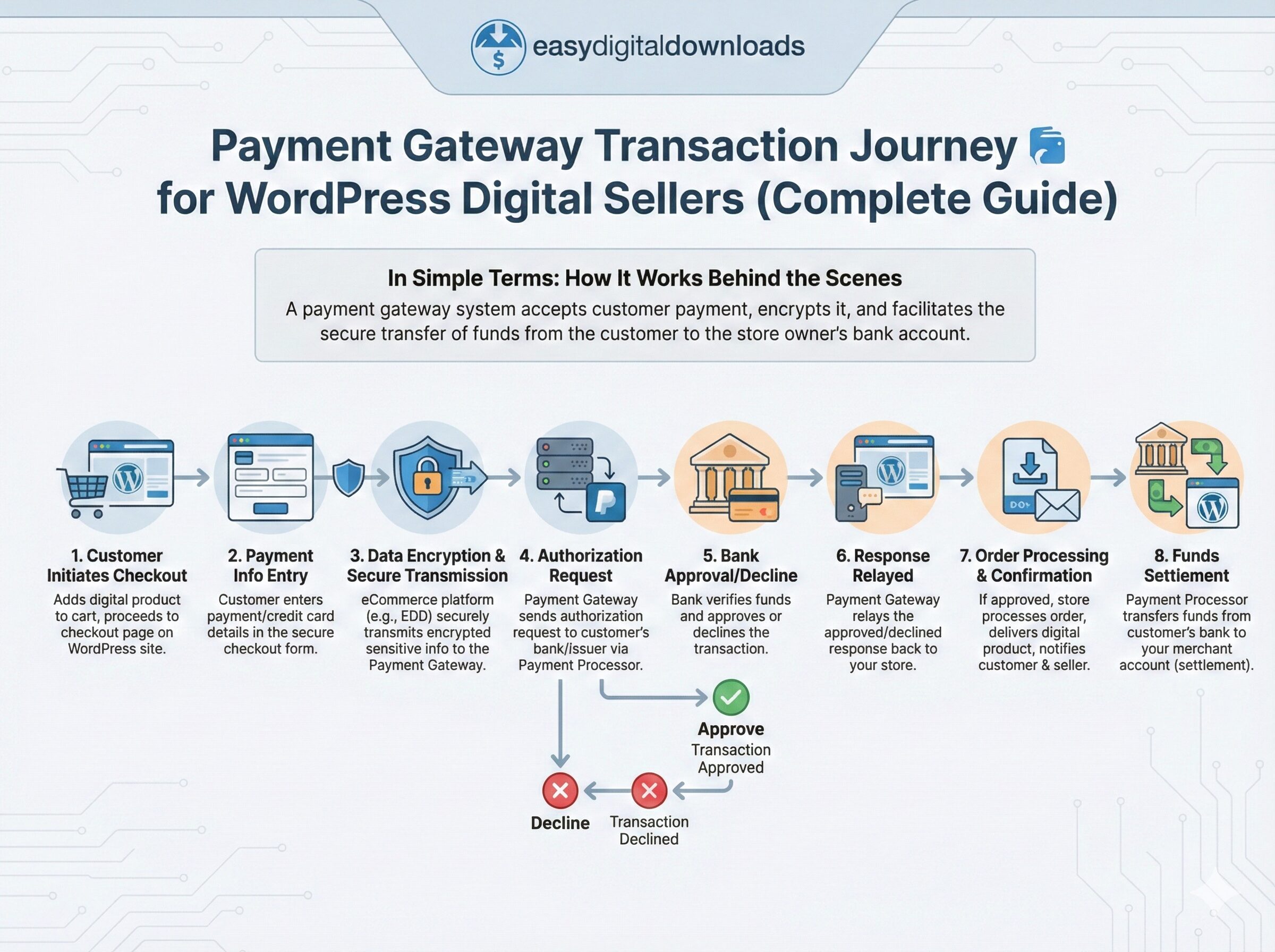

How Payment Gateways Work: Transaction Journey

Understanding payment processing helps with selecting the right solution and troubleshooting. It’s typically a straightforward process.

Here is the step-by-step transaction journey.

1. Customer Initiates Purchase: The customer adds items, proceeds to checkout on your WordPress site/your e-commerce plugin (e.g., Easy Digital Downloads, WooCommerce, etc.), generates a unique transaction ID, and calculates the final total.

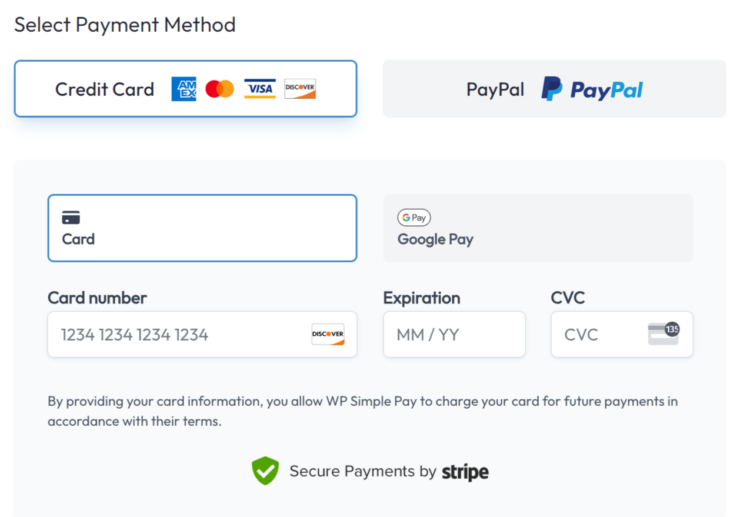

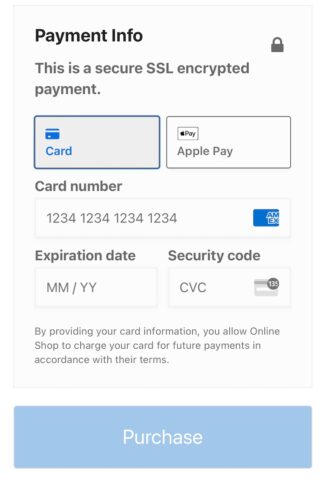

2. Payment Information Entry: The customer enters card and billing details on your checkout page (integrated) or a secure, hosted gateway page. The browser validates the data locally for initial errors.

3. Data Encryption & Secure Transmission: Upon submission, data is encrypted via SSL. The gateway receives this information securely via API. In a proper setup, sensitive card data bypasses your server.

4. Authorization Request to Payment Processor: The gateway forwards the data to the payment processor, which acts as the intermediary with the customer’s bank. The processor formats the authorization request according to card network rules, including card details, amount, merchant ID, and fraud scoring.

5. Bank Verification & Response: The customer’s issuing bank checks funds/credit, account status, and fraud indicators in real-time. If approved, the bank sends an authorization code, reserving the funds. If declined, a reason code is sent.

6. Response Relayed to Your Store: The approval/decline response is relayed back to your WordPress site via the processor and gateway. Approved transactions include a unique transaction ID. This takes 2-3 seconds.

7. Order Processing & Customer Notification: Upon approval, your e-commerce plugin marks the order as paid, triggers automated processes (e.g., immediate digital product delivery), and sends confirmation emails to the customer and merchant.

8. Settlement & Fund Transfer: Settlement, which moves the money, typically occurs in batches daily. The processor submits authorized transactions to card networks and banks. Funds transfer from the customer’s account to your merchant account.

Payment Gateway vs. Processor vs. Merchant

Understanding these interchangeable terms is key to choosing your payment setup.

Payment Gateway (“The Messenger”)

The gateway is the technology interface. It manages communication and data transmission between your store, the customer, and financial institutions (e.g., Stripe, PayPal). It does not move money

Payment Processor (“Delivery Service”)

The processor handles the actual fund transfers and communicates with card networks (Visa, Mastercard). They route and format transactions. Many modern companies like Stripe combine gateway and processor functions.

Merchant Account

This is a specialized business bank account where payment card funds are held temporarily before transfer to your regular business account. Traditional setups required a separate, complex application. All-in-one providers like Stripe use aggregate merchant accounts, simplifying the process.

How They Work Together

Traditionally, separate relationships were needed for the gateway, processor, and merchant account. All-in-one solutions (like Stripe) bundle these services, dramatically simplifying setup and management for small to medium businesses.

While potentially having slightly higher fees than separate, negotiated contracts, the convenience of the bundled approach generally outweighs the cost difference.

Types of Payment Gateways: Finding Your Fit

Not all gateways work the same way. The type you choose affects user experience, security requirements, and your ongoing responsibilities.

Below are the most common types of payment gateways you might encounter when setting up your online store.

Hosted (Redirect) Payment Gateways

Hosted gateways redirect customers to the gateway’s secure servers to complete payment. The customer leaves your site temporarily, enters their payment information, then returns to your store.

Examples include: PayPal Standard, 2Checkout, and some configurations of other major gateways. The customer sees the gateway’s branded payment page instead of your checkout form.

| Advantages ✅ | Disadvantages 👎 |

|---|---|

| Simplified PCI compliance since sensitive data never touches your server | Customers leave your website, creating a branding disconnect |

| Easy setup requiring minimal technical knowledge | Higher cart abandonment rates due to the redirect process |

| Lower development and maintenance requirements | Less control over the checkout experience and appearance |

| Gateway handles all security updates and compliance automatically | Potential confusion for customers who might think they’re being redirected to a different company |

Best for: Beginners, low-volume stores, or businesses with minimal technical resources who prioritize simplicity over customization.

Integrated (On-Site) Payment Gateways ⭐️

Integrated gateways allow customers to complete the entire checkout process without leaving your website. Payment forms appear directly on your checkout page, maintaining your brand experience.

Examples include: Stripe, PayPal Commerce, Square, and Authorize.net when properly configured. Customers see payment forms that match your site’s design and branding.

| Advantages ✅ | Disadvantages 👎 |

|---|---|

| Seamless, branded customer experience throughout checkout | Higher PCI compliance responsibilities since payment forms appear on your site |

| Complete control over the checkout flow and appearance | Slightly more complex setup requiring SSL certificates and proper configuration |

| Lower cart abandonment rates since customers never leave your site | Need to ensure your hosting environment meets security requirements |

| More professional appearance that builds trust |

Best for: Growing businesses, those prioritizing brand experience, and WordPress users with Easy Digital Downloads or WooCommerce who want professional checkout experiences.

API-Based (Self-Hosted) Gateways

API-based gateways give you maximum control by integrating directly with the gateway’s programming interface. This allows completely custom checkout experiences and unique payment flows.

Examples include: direct integration with Stripe’s API, Braintree’s SDK, or custom implementations with other major gateways. Developers build custom checkout experiences using the gateway’s tools.

| Advantages ✅ | Disadvantages 👎 |

|---|---|

| Maximum customization potential for unique business requirements | Requires significant developer knowledge and ongoing maintenance |

| Complete control over user experience and checkout flow | Full PCI compliance burden falls on your business |

| Ability to create innovative payment features not available in standard integrations | More complex troubleshooting when issues arise |

| Higher development and maintenance costs |

Best for: Large businesses, companies with unique requirements, or those with dedicated development resources who need custom payment experiences.

Local Bank Integration Gateways

Local bank gateways connect directly with specific banks or regional payment networks. These often provide preferred payment methods for customers in specific geographic regions.

Examples include: iDEAL (Netherlands), Sofort (Europe), Alipay (China), and various local bank partnerships. These cater to regional preferences and banking systems.

| Advantages ✅ | Disadvantages 👎 |

|---|---|

| Often lower fees for transactions within the supported region | Limited geographic availability restricting market expansion |

| Preferred by customers who trust their local banking systems | Fewer features compared to major international gateways |

| Bank-level security that customers recognize and trust | May require separate integrations for each region you want to serve |

| Better acceptance rates in specific geographic markets | Less comprehensive fraud protection and analytics |

Best for: Businesses targeting specific geographic markets, international sellers wanting to offer local payment preferences, or companies focused on particular regions.

Popular Payment Methods Supported

Today’s customers expect payment flexibility, and modern gateways support far more than just traditional credit cards.

Traditional Payment Methods

Credit cards remain the backbone of online payments. Visa, Mastercard, American Express, and Discover are universally expected by customers.

Debit cards work similarly to credit cards but draw funds directly from checking accounts.

These traditional methods are still essential because they’re universally accepted and trusted. Average transaction fees for card payments typically range from 2.9% to 3.5% plus a flat fee.

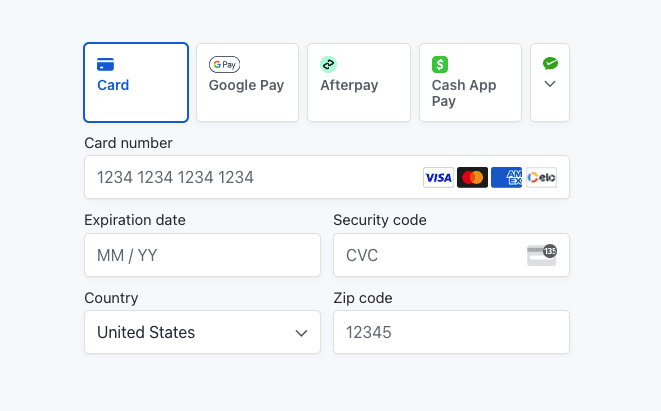

Digital Wallets (The Growing Standard)

Apple Pay and Google Pay are becoming increasingly popular, especially on mobile devices. These wallets store encrypted payment information securely on devices.

Digital wallets improve conversion rates because they eliminate the need to enter card information manually. Customers can complete purchases with a fingerprint or face scan.

The security benefits are substantial. Digital wallets use tokenization, so actual card numbers never get transmitted during transactions. This reduces fraud risk significantly.

Mobile commerce considerations make digital wallets essential. More than half of online purchases now happen on mobile devices, where digital wallets provide the smoothest experience.

Buy Now, Pay Later (BNPL)

BNPL options like Klarna, Afterpay, Affirm, and PayPal Pay in 4 are exploding in popularity. These services let customers split purchases into installments without traditional credit applications.

BNPL increases average order values because customers can afford larger purchases when spread over time. This is particularly effective for fashion, electronics, and home goods.

Target demographics for BNPL are primarily millennials and Gen Z consumers who prefer avoiding traditional credit. However, adoption is spreading across all age groups.

Merchant considerations include higher fees (typically 3-8% of transaction value) but potential increases in conversion rates and order values that can offset the costs.

Bank Transfers & ACH Payments

ACH (Automated Clearing House) payments allow direct bank-to-bank transfers without credit cards. These are popular for larger purchases and B2B transactions.

Direct bank transfers typically have much lower fees (often under 1%) but longer processing times. Settlement can take 3-5 business days instead of 1-3 days for cards.

Best use cases include B2B transactions, high-ticket items where lower fees matter, and recurring payments where processing time is less critical.

Regional & Alternative Payment Methods

International expansion requires supporting regional payment preferences. Alipay and WeChat Pay dominate in China. iDEAL is preferred in the Netherlands. Sofort is popular across Europe.

Offering regional payment methods can significantly increase conversion rates in international markets. Customers strongly prefer familiar, trusted payment options.

The complexity comes from integrating multiple regional gateways and understanding local regulations, currencies, and consumer preferences.

How to Choose a WordPress Payment Gateway

Nearly every online store requires a payment gateway to process payments. But not every business has the same requirements or factors to consider.

Choosing an online payment gateway can be one of the most important decisions you make when setting up your store, so it is important to consider the options carefully.

Below are some key aspects to consider when researching, comparing, and choosing a WordPress payment gateway.

1. Assess Your E-Commerce Platform

Your choice starts with your website setup and technical capabilities. If you’re using WordPress for your e-commerce site, the two most popular plugins to use are Easy Digital Downloads (for digital products) and WooCommerce (physical products).

Plugins like these provide built-in support for major standard gateways (Stripe, PayPal, etc.), while other platforms require premium extensions.

Consider your technical expertise honestly. Some gateways require minimal setup, while others need developer involvement for proper configuration and customization.

Your hosting environment matters too. Shared hosting might limit your options compared to dedicated or managed WordPress hosting that provides better security and performance.

2. Evaluate Transaction Fees & Pricing Structures

Transaction fees directly impact your profitability, so understanding the complete fee structure is crucial before making decisions.

Most gateways charge percentage-based fees (typically 2.9% to 3.5%) plus flat per-transaction fees (usually $0.30). These might seem small individually but add up quickly.

Monthly fees vary widely. Some gateways charge no monthly fees, while others charge $25-$100+ monthly. Consider your transaction volume when evaluating monthly vs. per-transaction costs.

Setup fees are becoming less common but still exist with some traditional processors. Many modern gateways offer free setup to attract merchants.

Currency conversion fees apply when accepting international payments. These typically add 1-2% to international transactions, which can be significant for global businesses.

Hidden fees to watch for:

- Statement fees for detailed reporting

- PCI compliance fees for security requirements

- Gateway fees separate from processor fees

- Chargeback fees when customers dispute transactions

Volume discounts become available as your sales grow. Most gateways offer reduced rates for businesses processing significant monthly volumes.

With Easy Digital Downloads Pro, you can eliminate transaction fees when using Stripe. This benefit alone can save hundreds or thousands of dollars monthly for active stores.

💡 Learn more about EDD Free vs Pro plans.

3. Consider Your Business Model & Product Type

Different business models have different payment gateway requirements that affect which options work best for your situation.

Digital products benefit from instant delivery capabilities. EDD excels at this, automatically delivering download links and license keys immediately after payment approval.

Physical products need shipping integration and inventory management. Consider how your gateway integrates with shipping calculators and inventory tracking systems.

Services requiring appointment booking or scheduling need gateways that integrate with calendar and booking systems. Some gateways offer better support for service-based businesses.

Subscription and recurring billing support varies significantly between gateways. If you plan to offer memberships or recurring products, ensure your gateway handles automatic billing reliably.

Free trials and pre-authorization holds require specific gateway capabilities. Not all providers support holding funds without charging immediately.

4. Prioritize Security & Compliance

Security isn’t optional—it’s essential for protecting customers and your business reputation. Different gateways provide different levels of security features and compliance support.

PCI DSS compliance requirements vary based on your transaction volume and how you handle payment data. Most WordPress store owners fall into the lowest compliance level, but you still need to meet basic requirements.

SSL certificates are mandatory for all payment processing. Ensure your hosting provider supports SSL and that you understand how to maintain certificate validity.

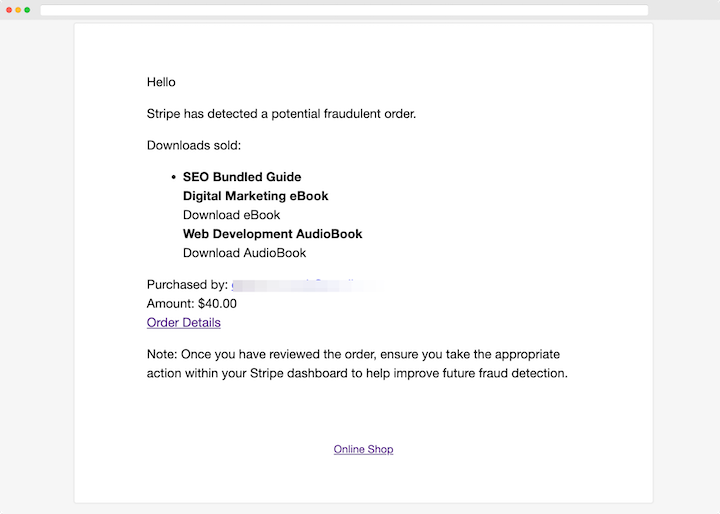

Fraud detection tools vary significantly between providers. Advanced systems like Stripe Radar use machine learning to identify suspicious patterns in real-time.

That’s why Easy Digital Downloads uses Stripe’s Early Fraud Warnings to prevent chargeback fees.

3D Secure (3DS) authentication adds an extra security layer by requiring customers to verify their identity with their card issuer. This reduces fraud but can slightly decrease conversion rates.

Tokenization capabilities replace sensitive card data with random tokens, making stored payment information useless to hackers. This is particularly important for businesses storing customer payment methods.

5. Examine Geographic & Currency Support

Your target market geography significantly affects which gateways work best for your business expansion plans.

Not all gateways operate in all countries. Stripe supports many countries, but isn’t available everywhere. PayPal has broader geographic availability but different features in different regions.

Multi-currency payment acceptance lets international customers pay in their preferred currencies. This typically increases conversion rates for global businesses.

Currency conversion handling varies between gateways. Some handle conversions automatically, while others leave it to the customer’s bank. Each approach has different fee implications.

Cross-border transaction fees often add 1-3% to international sales. Factor these costs into your international pricing strategy.

Settlement currencies determine what currencies you can actually receive funds in. You might accept euros but only receive settlements in US dollars, for example.

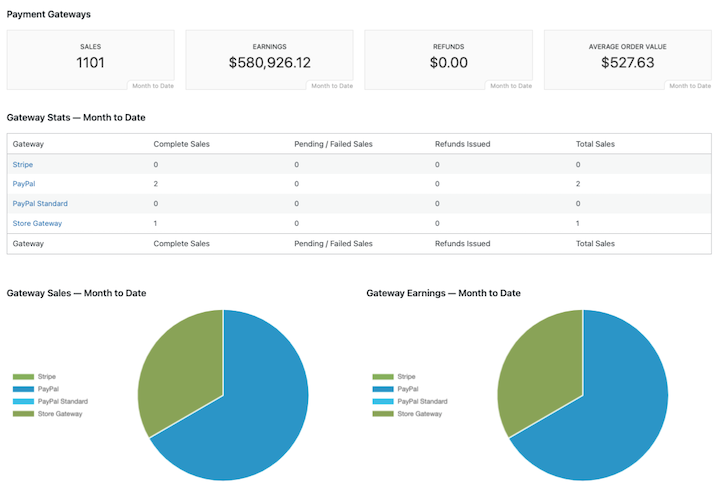

6. Review Reporting & Analytics Features

Comprehensive reporting helps you understand your business performance and identify opportunities for optimization.

Transaction reports and export capabilities let you analyze sales patterns, identify top products, and track revenue trends over time.

Customer payment history tracking helps you provide better customer service and identify high-value customers for special treatment.

Failed payment monitoring alerts you to potential issues with your checkout process or specific payment methods that might need attention.

Real-time dashboard access provides immediate visibility into your business performance, especially valuable during sales events or product launches.

7. Consider Scalability & Future Growth

Choose a gateway that can grow with your business rather than requiring expensive migrations later.

Volume limitations might restrict your growth with some providers. Understand any transaction limits or account restrictions that could affect your business expansion.

Multi-store support becomes important if you plan to operate multiple websites or brands. Some gateways make this easier than others.

API rate limits could become problematic for high-volume businesses or those using extensive automation. Ensure your chosen gateway can handle your expected transaction volume.

Top Payment Gateway Options (WordPress & EDD)

Based on our evaluation criteria, here are the leading gateway options for WordPress store owners, with specific focus on EDD compatibility and ease of use.

Stripe (Recommended for Most Users)

Stripe has become the gold standard for online payments, offering an excellent balance of features, pricing, and ease of use for WordPress store owners.

Key features:

- Supports 135+ currencies and 40+ countries

- All major payment methods, including cards, Apple Pay, Google Pay, and BNPL options

- Stripe Link lets returning customers check out with one click

- Advanced fraud detection through Stripe Radar

- Robust API for custom development when needed

- Built-in subscription billing for recurring products

Pricing: 2.9% + $0.30 per transaction for most US card payments.

EDD integration benefits:

- Native support included in EDD Free

- Full feature access with EDD Pro, including elimination of Stripe transaction fees

- Access to all Stripe payment methods

- Early fraud warnings to prevent chargebacks

- Seamless recurring payment support for subscription products

- Easily accept multi-currency payments

- Tons of payment metjhod options

Stripe is reliable and feature-rich. The customer experience is smooth, and the dashboard provides excellent transaction insights.

🏆 Best for: Most online sellers, especially those selling digital products, businesses prioritizing user experience, and stores expecting to grow significantly.

💡Learn how to sell digital products with Stripe.

PayPal Commerce (Solid Alternative)

PayPal remains one of the most recognized payment brands globally, making it a solid choice for businesses whose customers prefer the PayPal ecosystem.

Key features:

- Operates in 200+ countries and supports 25+ currencies

- PayPal, Venmo, and Pay Later options in one integration

- Strong buyer and seller protection programs

- No monthly fees for standard accounts

- Familiar interface that many customers trust and prefer

Pricing: 2.99% + $0.49 per transaction for US standard rate

EDD integration:

- PayPal Commerce Pro available for EDD users

- Advanced features unlock with EDD Pro plans

- Supports both PayPal account and credit card payments

I’ve found PayPal particularly valuable for international sales and customers who specifically prefer PayPal’s buyer protection. The brand recognition can increase conversion rates for certain demographics.

Best for: International sellers, businesses whose customers prefer PayPal brand recognition, stores selling to demographics that heavily use PayPal.

Authorize.net (Enterprise-Focused)

Authorize.net is one of the oldest payment gateways, offering robust features particularly suited for established businesses with higher transaction volumes.

Key features:

- Comprehensive fraud detection suite with customizable rules

- Accepts all major payment methods including ACH/eCheck

- Advanced recurring billing capabilities

- Customer Information Manager for storing payment profiles

- Detailed reporting and analytics

Pricing: $25/month + 2.9% + $0.30 per transaction

EDD integration: Available with Pro plans.

Authorize.net works well for businesses that need advanced fraud controls and detailed reporting. The monthly fee can be justified by lower per-transaction costs at higher volumes.

Best for: Established businesses with consistent monthly sales, stores needing advanced fraud detection, businesses processing significant transaction volumes monthly.

Square (Unified Commerce Solution)

Square excels for businesses that sell both online and in physical locations, offering integrated POS and e-commerce solutions.

Key features:

- Free POS hardware options for in-person sales

- Unified reporting across online and in-person transactions

- No monthly fees for basic accounts

- Next-day deposit availability

- Integrated inventory management across channels

Pricing: 2.9% + $0.30 for online transactions; 2.6% + $0.10 for in-person sales

EDD integration: Built-in support. Plus, a special sign-up offer.

I recommend Square for clients who need both online and offline payment processing. The unified reporting and inventory management are particularly valuable for hybrid businesses.

Best for: Businesses selling both online and in-person, retail stores adding e-commerce, service providers who meet customers in person.

Payment Gateway Mistakes to Avoid ⚠️

Learn from critical errors to save time, money, and frustration.

Implementation Errors

- Insufficient pre-launch testing: Always test multiple scenarios (success, decline, various methods) before launch. Use EDD to easily test Stripe payments.

- Missing SSL certificate: This prevents secure processing and causes cart abandonment.

- Incorrect webhook configurations: Prevents proper store communication, leading to incomplete orders or inventory issues. EDD lets you automatically configure webhooks in one click.

- Failing to enable desired payment methods: Unnecessarily limits customer options (e.g., Apple Pay).

Security Oversights

- Insufficient PCI compliance: Can result in fines and liability. Understand and implement required security measures.

- Weak password protection: Use strong, unique passwords and enable two-factor authentication.

- Not monitoring fraud: Leads to chargebacks and losses. Set up rules and monitor patterns.

- Ignoring security updates: Leaves your site vulnerable. Keep WordPress, plugins, and themes current.

Cost Management Issues

- Not comparing or overlooking total fees: Leads to high processing costs. Consider all transaction, monthly, and additional charges. Hidden fees can impact profitability (e.g., statement fees, PCI charges, international costs).

- Not leveraging available benefits: Missing out on options like transaction fee elimination costs money.

Customer Experience Problems

- Too many checkout steps: Increases cart abandonment. Streamline the checkout process.

- Forcing account creation: Offer guest checkout to prevent losing potential customers.

- Not offering preferred payment methods: Reduces conversion rates; research and accommodate customer payment preferences.

- Poor mobile checkout: Critical since most purchases are mobile. Test thoroughly on various devices.

- Unclear error messages: Frustrates customers and prevents successful retry attempts. Provide clear guidance.

FAQs about Payment Gateways for WordPress

Let’s wrap up with some frequently asked questions, from ‘what is a payment gateway?’ to ‘what to expect when setting one up‘ for your WordPress site.

What is a payment gateway and how does it work?

A payment gateway serves as a bridge between an online store, its customers, and their financial institutions. It enables secure transmission of transaction information during the checkout process.

When a customer enters payment details on a website, the gateway works by encrypting and sending that data to the customer’s bank or card issuer for authorization. Upon approval, the gateway relays the transaction status back to the store, facilitating order processing and delivery of digital products.

What’s the difference between a payment gateway and a payment processor?

A payment gateway is the technology that securely transmits payment data between your website and financial institutions. A payment processor handles the actual movement of funds between banks. Many modern services like Stripe combine both functions into one integrated solution.

How much do payment gateways typically cost online merchants?

Payment gateway costs typically range from 2.9% to 3.5% per transaction plus $0.30 flat fees. Some charge monthly fees ($25-$100+) while others like Stripe have no monthly fees. Easy Digital Downloads Pro eliminates transaction fees entirely with Stripe, potentially saving hundreds monthly.

Do I need a merchant account to accept credit card payments?

Traditional gateways required separate merchant accounts, but modern all-in-one solutions like Stripe and PayPal include aggregate merchant accounts. This eliminates separate applications and makes setup much simpler for small to medium businesses.

Try the Top Payment Gateways for WordPress

A well-chosen payment gateway is the backbone of any successful online store. By understanding the different types of gateways, their features, and the associated fees, you can equip your e-commerce business with a secure and efficient payment processing system, paving the way for increased sales and a seamless customer experience.

Don’t underestimate the power of a good payment gateway – it’s an investment that will pay off.

Want access to the leading payment gateways for WordPress eCommerce sites? Grab an Easy Digital Downloads pass and incorporate multiple gateways at no additional cost!

What’s next? Learn more about e-commerce website costs and how to make one via WordPress.

📣 P.S. Be sure to subscribe to our newsletter and follow us on Facebook, Twitter/X, or LinkedIn for more WordPress resources!